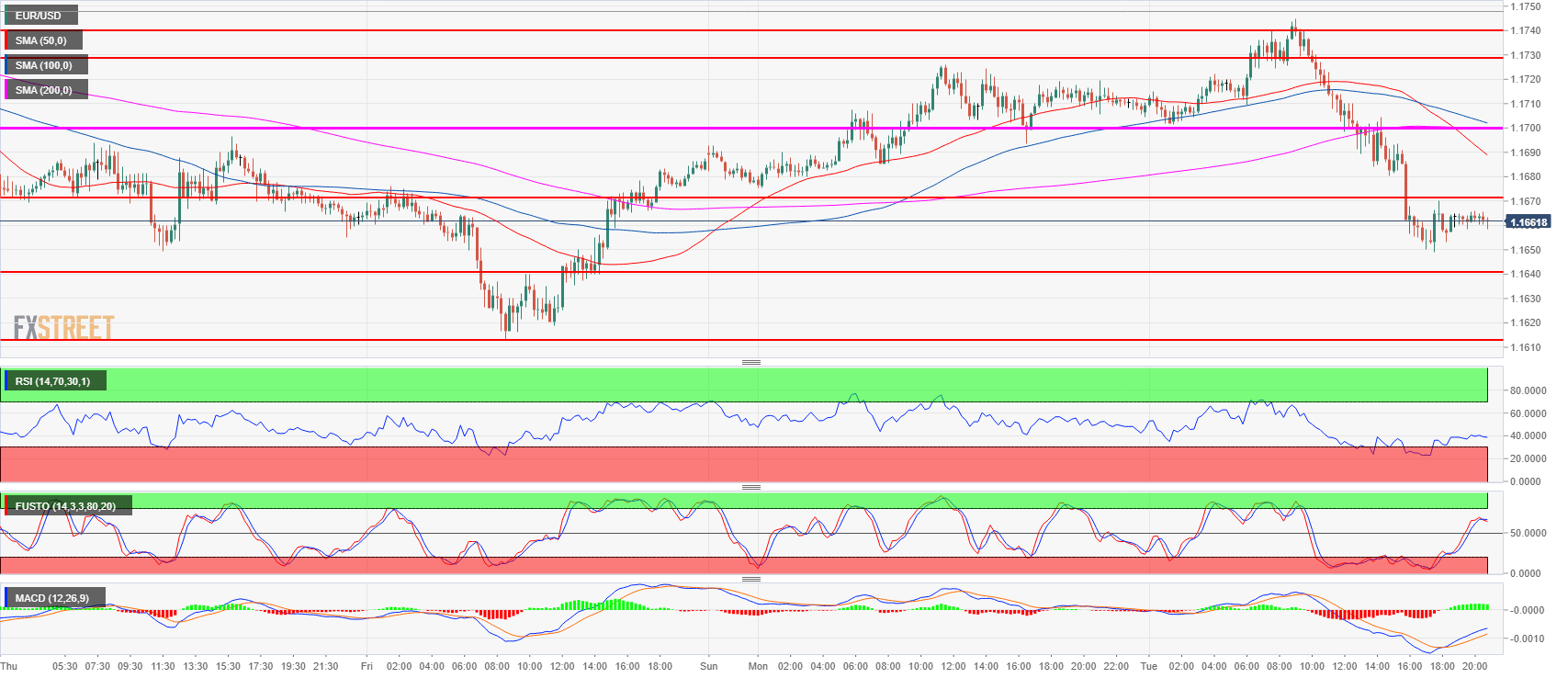

- EUR/USD had a failed breakout above 1.1740 earlier in Europe after which it lost almost a 100 pips to the downside. After it made a daily low at 1.1649, prices remained contained below 1.1672 which is now acting as near-term resistance.

- The bears are quite strong and EUR/USD should progress lower as long as it stays below 1.1672 and 1.1700 resistances. The idea of bull breakout above 1.1740 seems at the moment unlikely unless a fundamental catalyst shocks the market.

- Bear targets are seen near 1.1640-1.1649 area and 1.1613, last week’s low.

EUR/USD 15-minute chart

Spot rate: 1.1657

Relative change: -0.42%

High: 1.1745

Low: 1.1649

Trend: Bearish

Resistance 1: 1.1672 June 27 high

Resistance 2: 1.1700 figure

Resistance 3: 1.1730-1.1740 area, 23.6% Fibonacci retracement from mid-April-May bear move and last week’s open.

Resistance 4: 1.1790 last week’s high

Resistance 5: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1640-1.1649 area, key level and July 12 low

Support 2: 1.1613 last week’s low

Support 3: 1.1600 figure

Support 4: 1.1560 June 14 low

Support 5: 1.1508 current 2018 low