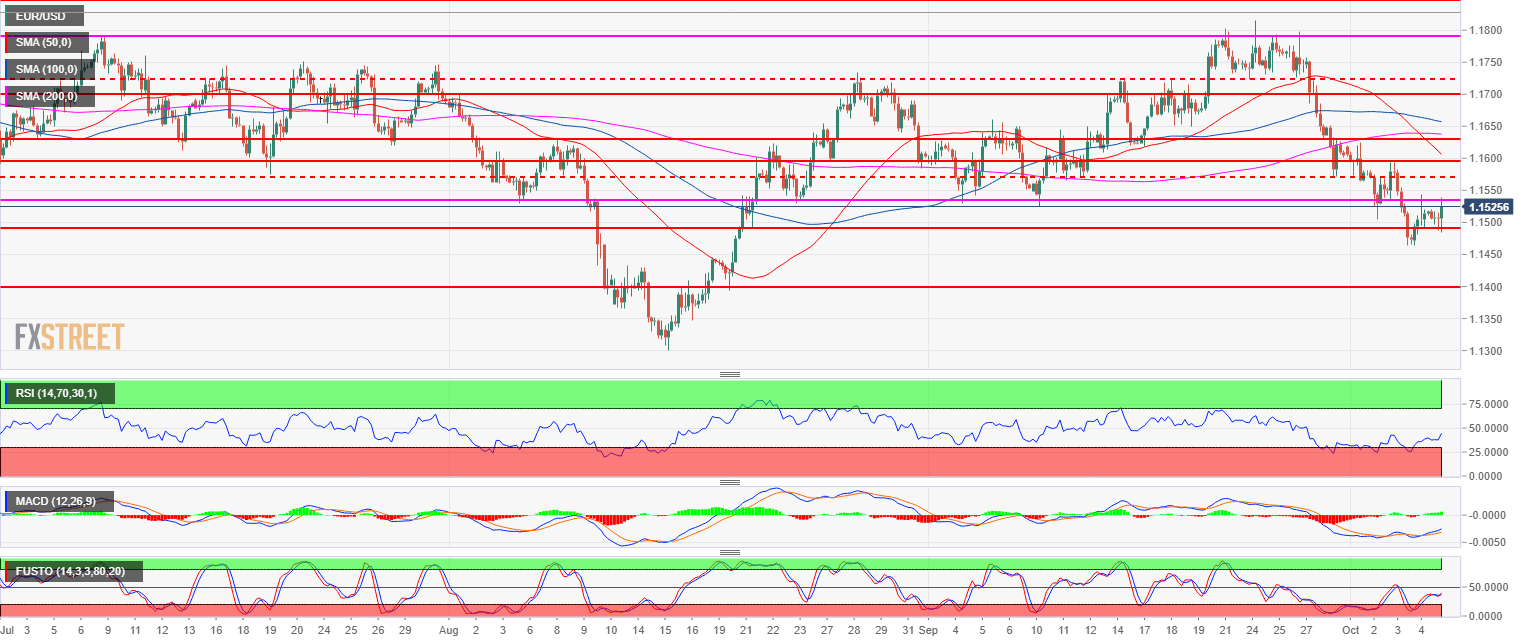

- EUR/USD is challenging the 1.1530 key level after the release of the US Nonfarm Payrolls (Sept) which came in at 134K versus 270K forecast.

- EUR/USD is trading below its 50, 100 and 200-period simple moving averages while the RSI, MACD and Stochastics are gaining bullish traction.

- If bulls can break above 1.1530 then 1.1569 (Sept. 28 low) and 1.1600 figure become the next target. On the flip side bears objective is to keep the market below 1.1530.

Spot rate: 1.1527

Relative change: -0.11%

High: 1.1539

Low: 1.1484

Main trend: Bearish

Resistance 1: 1.1530 August 23 swing low

Resistance 2: 1.1569 Sept. 28 low

Resistance 3: 1.1600 figure

Resistance 4: 1.1630 August 8 high key level

Resistance 5: 1.1654 August 27 high

Support 1: 1.1500 figure and October 2, swing low

Support 2: 1.1491 August 21 low

Support 3: 1.1400 figure

Support 4: 1.1350 figure