- EUR/USD has lost about 40 pips from daily highs in tandem with GBP/USD as British Foreign Secretary Boris Johnson resigns.

- The fall in EUR/USD coincides with broad-based USD strength. Whether it can be sustained in the long run remains to be seen but bears are trying hard to prevent EUR/USD from rising above 1.1800 level.

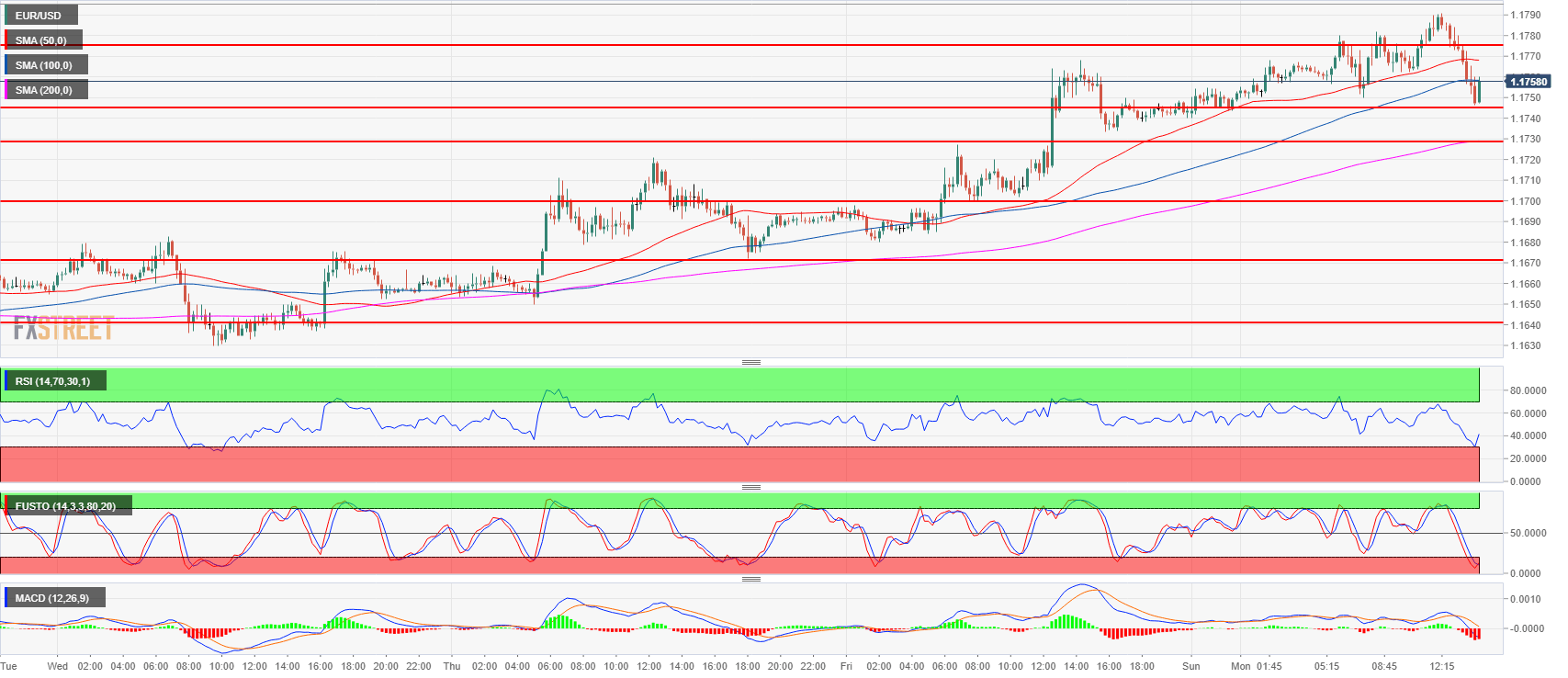

- A bear breakout below 1.1740, open of the week, can lead to buyers capitulation and more down while if 1.1740 remains supported higher prices can be on the cards.

EUR/USD 15-minute chart

Spot rate: 1.1758

Relative change: 0.12%

High: 1.1791

Low: 1.1740

Trend: Bullish

Resistance 1: 1.1800 figure

Resistance 2: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Resistance 3: 1.1900 figure

Support 1: 1.1740-1.1774 area, open of the week and intraday demand level.

Support 2 1.1700-1.1730, figure and 23.6% Fibonacci retracement from mid-April-May bear move

Support 3: 1.1672 June 27 high

Support 4: 1.1640 supply/demand level

Support 5: 1.1600 figure

Support 6: 1.1560 June 14 low

Support 7: 1.1508 current 2018 low