- The US Core Consumer Price Index Year-onYear (CPI) came in better-than-expected at 2.2% vs. 2.1% forecast by analysts.

- EUR/USD keeps trading near daily highs despite the slightly better-than-anticipated US inflation data.

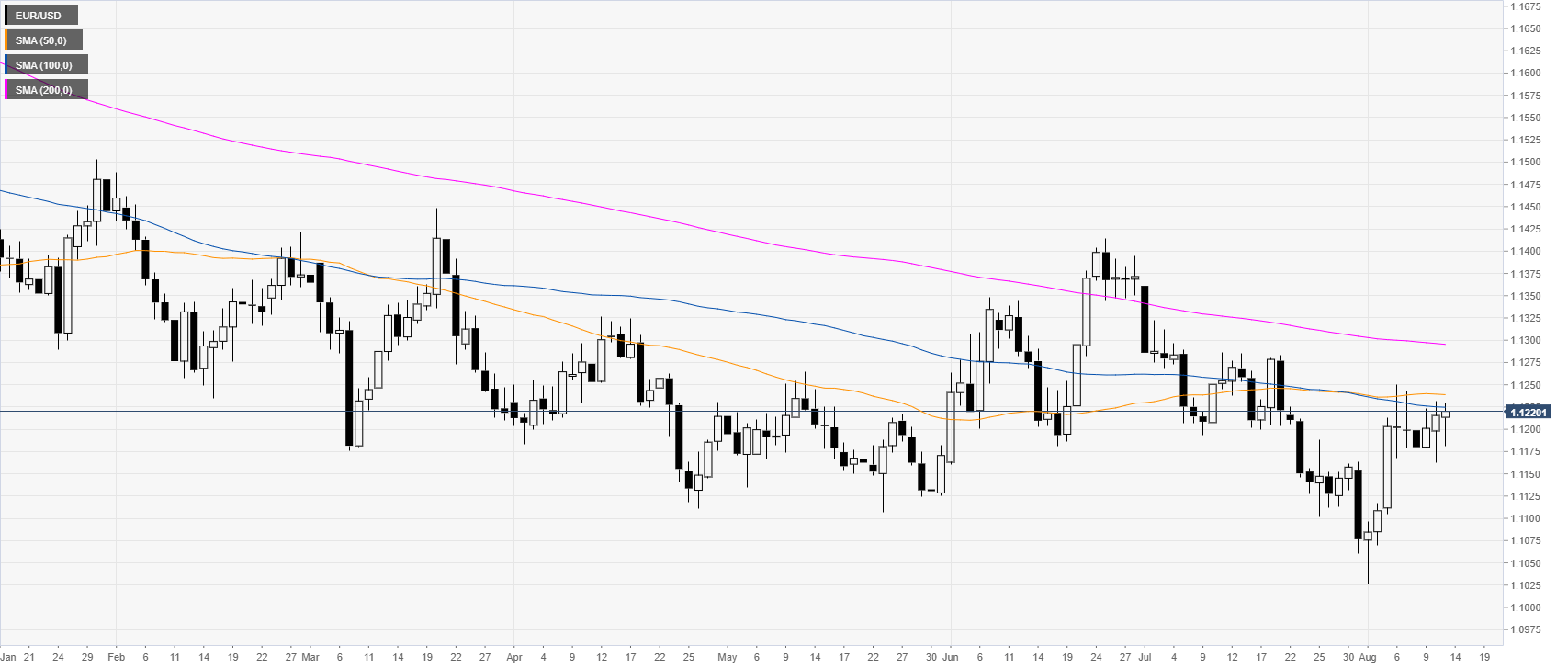

EUR/USD daily chart

EUR/USD is in consolidation mode for the sixth consecutive day. The Euro is currently capped by the 1.1220/55 resistances and the 50/100-day simple moving averages (DSMAs). The US CPI came in slightly better-than-anticipated. However, the US Dollar remains under relative pressure.

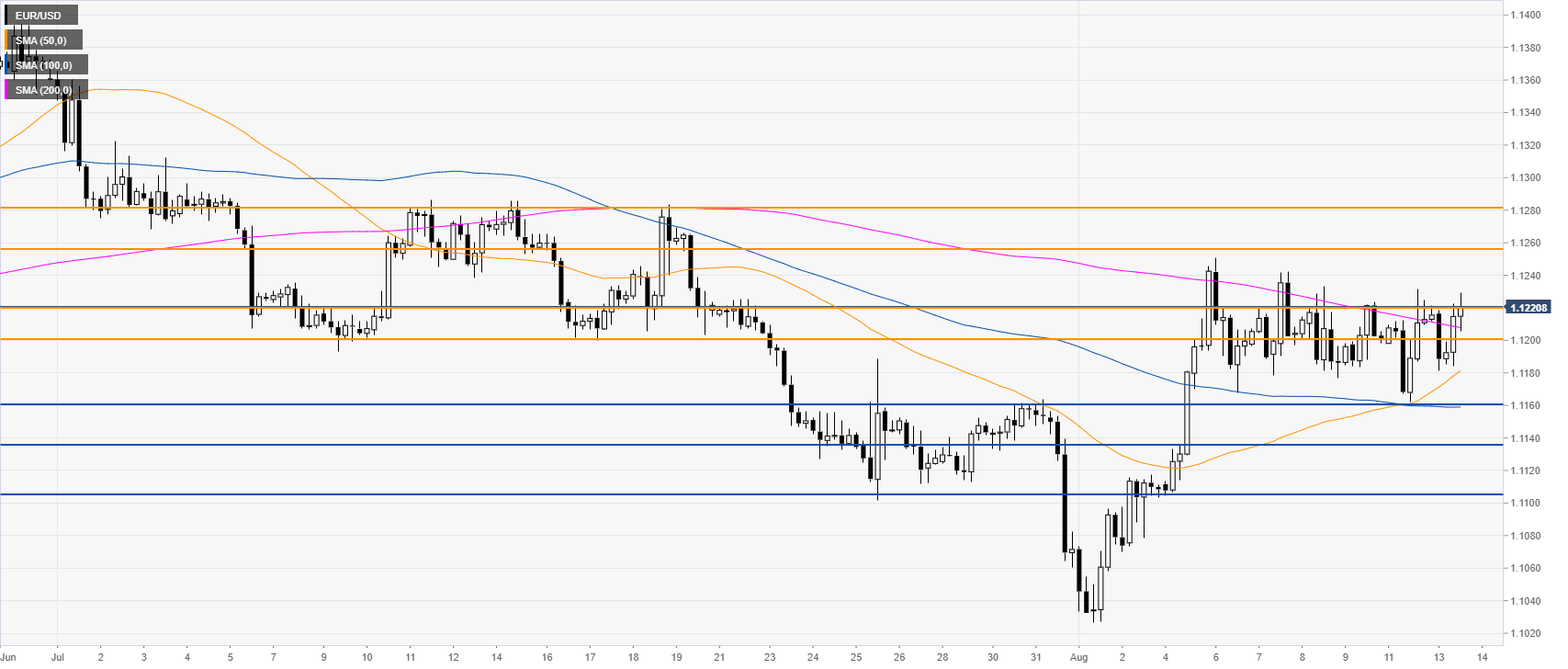

EUR/USD 4-hour chart

EUR/USD is in a range between the 1.1255 resistance and the 1.1160 support while the market is trading above a downward sloping 200 SMA. Bulls are once again attempting to break away from the 1.1220 level to reach 1.1255 resistance. However, the market seems for now reluctant to make any significant move in either direction.

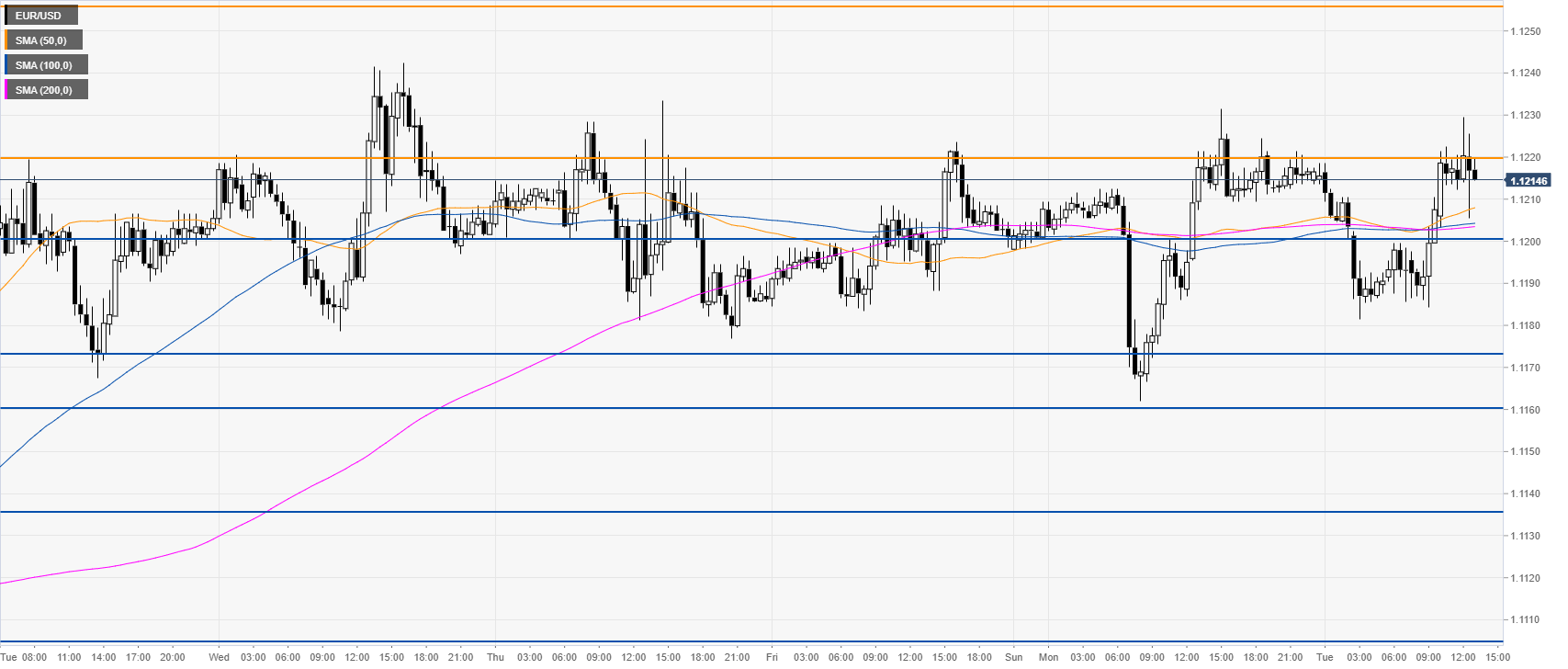

EUR/USD 30-minute chart

The market seems to have little convictions to break above 1.1220, therefore, keeping the range theme intact for now. Support is at 1.1200 followed by the 1.1173 and 1.1160 levels, according to the Technical Confluences Indicator.

Additional key