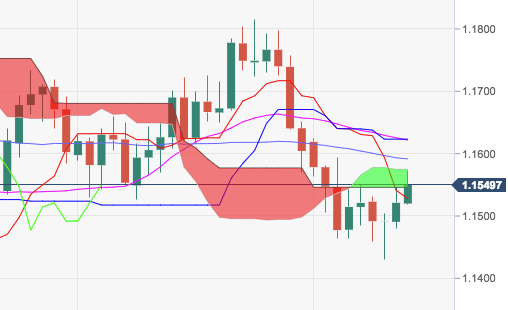

- The pair’s recovery has met a strong resistance in the 1.1570 region so far, although the bull run still carries the potential to re-visit the 55-day SMA at 1.1592 ahead of 1.1623, where sits the 21-day SMA.

- In case the bullish impetus gathers further traction, then the 1.1790 region should return to the radars.

- On a resumption of the weak note, immediate contention emerges at weekly lows in the 1.1435/30 band ahead of the critical 200-dweek SMA at 1.1326.

EUR/USD

Overview:

Last Price: 1.1547

Daily change: 26 pips

Daily change: 0.226%

Daily Open: 1.1521

Trends:

Daily SMA20: 1.1625

Daily SMA50: 1.1585

Daily SMA100: 1.163

Daily SMA200: 1.1925

Levels:

Daily High: 1.1546

Daily Low: 1.148

Weekly High: 1.1625

Weekly Low: 1.1464

Monthly High: 1.1816

Monthly Low: 1.1464

Daily Fibonacci 38.2%: 1.1521

Daily Fibonacci 61.8%: 1.1505

Daily Pivot Point S1: 1.1485

Daily Pivot Point S2: 1.1449

Daily Pivot Point S3: 1.1419

Daily Pivot Point R1: 1.1552

Daily Pivot Point R2: 1.1582

Daily Pivot Point R3: 1.1618