- EUR/USD remains on the defensive for yet another day and is not putting the 1.1300 key support to the test.

- The lost of 1.1300 the figure should open the door for a quick drop to test 1.1188, which represents the 61.8% Fibo retracement of the 2017-2018 up move.

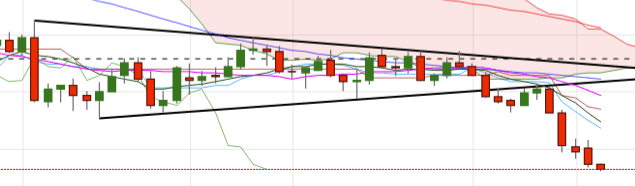

- Occasional, albeit unlikely, bullish attempts should meet interim resistance at 1.1493 (10-day SMA) seconded by 1.1590 (21-day SMA), all ahead of the more relevant hurdle around 1.1630, where sit last week’s tops, the base of the daily cloud and the bottom line of the pennant formation in the daily chart.

- No change in the near/medium term outlook for the pair, which remains negative as long as the 1.1745/50 band caps the upside.

Daily high: 1.1351

Daily low: 1.1316

Support Levels

S1: 1.1306

S2: 1.1268

S3: 1.1207

Resistance Levels

R1: 1.1406

R2: 1.1468

R3: 1.1506