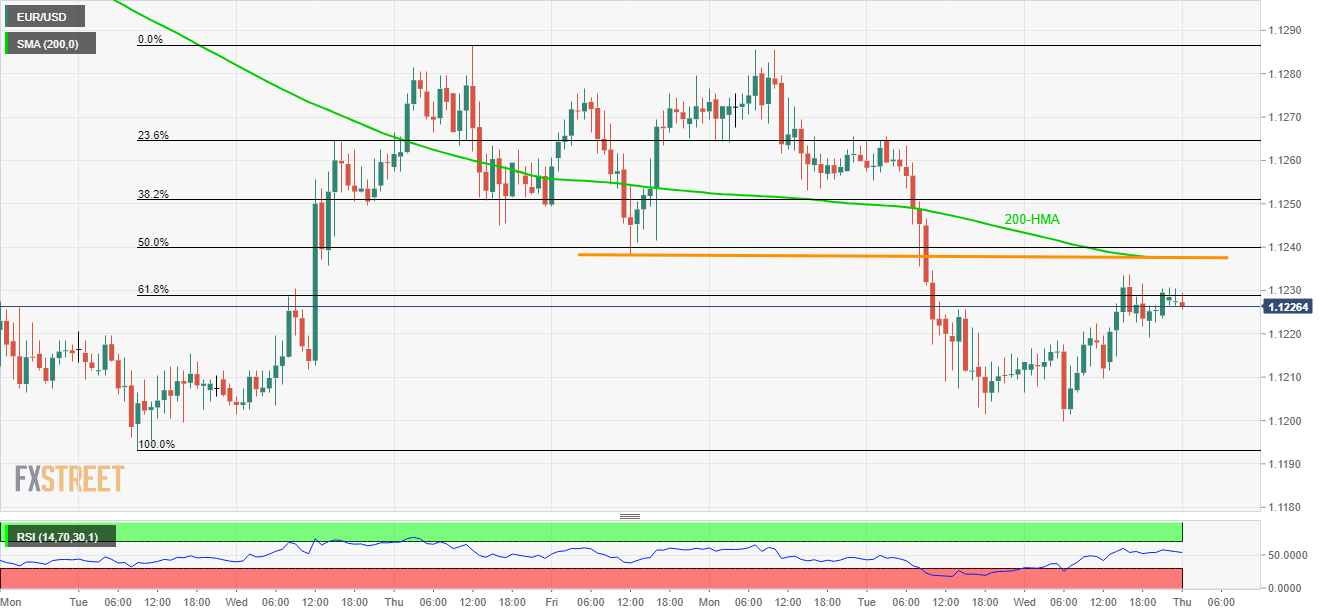

- 200-HMA, late last-week low highlight 1.1238/40 as the key upside barrier for EUR/USD.

- Lower high, steady RSI can recall sub-1.1200 area on the chart.

With the recent lower high formation and steady levels of 14-bar relative strength index (RSI) signaling the buyers’ exhaustion, the EUR/USD pair witnesses pullback to 1.1226 during early Thursday.

Not only recently trading pattern and RSI but failure to rise past-key resistance area also indicate the pair’s weakness, which in turn highlights 1.1215 and 1.1200 as nearby supports ahead of pushing sellers towards monthly low near 1.1193.

If bears dominate sentiment below 1.1193, June month bottom close to 1.1181 could quickly appear on their radar.

On the flip side, a sustained break of 1.1238/40 area comprising 200-hour moving average (HMA) and late last week’s low seems the key for buyers to watch as a break of which can trigger the pair’s fresh advances to 1.1250/55 and 1.1280 numbers to the north.

Additionally, pair’s successful rise beyond 1.1280 enables it to confront 200-day moving average on daily chart that levitates around 1.1320 by the press time.

EUR/USD hourly chart

Trend: Pullback expected