- EUR/USD sellers dominate around the fresh yearly low.

- Oversold RSI, near-term falling trend-line could question bears.

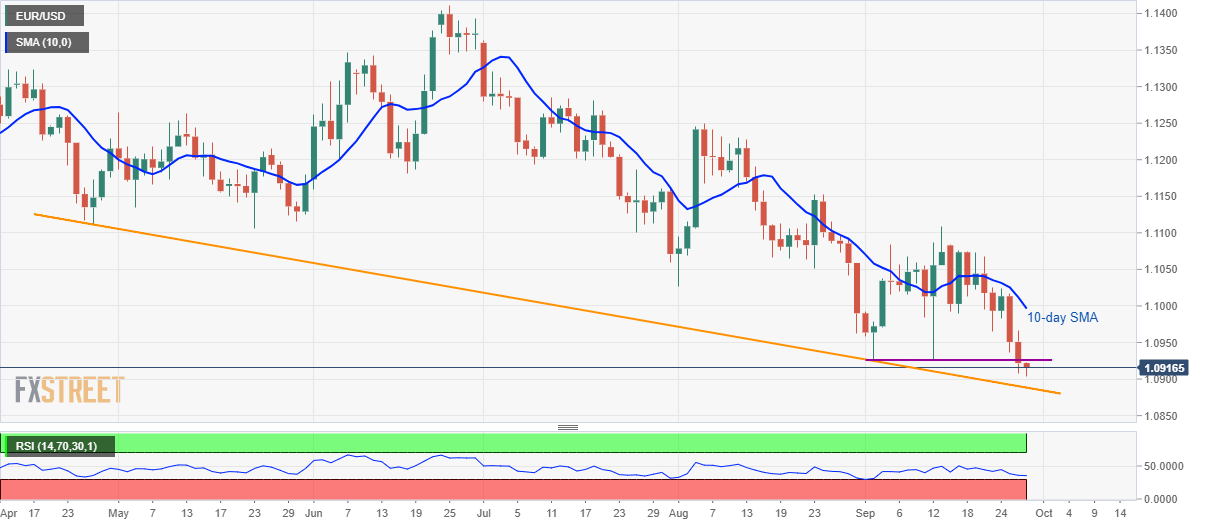

While sustained trading below three-week-old support (now resistance) portrays the EUR/USD pair’s weakness, nearness to key support-line, amid oversold RSI, keeps buyers hopeful while the quote seesaws near 1.0915 during early Friday.

As a result, counter-trend traders will look for a bounce from a falling trend-line since late-April, at 1.0890, in order to challenge immediate resistance-line, at 1.0925/27, a break of which could escalate the recovery to 1.0960/65 and 10-day simple moving average (SMA) near 1.1000 mark.

It should, however, be noted that pair’s sustained run-up beyond 1.1000 enable bulls to aim for monthly top close to 1.1110.

In a case when bears refrain from respecting the oversold condition of 14-day relative strength index (RSI), May 2017 low near 1.0840 and April 2017 gap of 1.0740 will flash on sellers’ radar.

EUR/USD daily chart

Trend: pullback expected