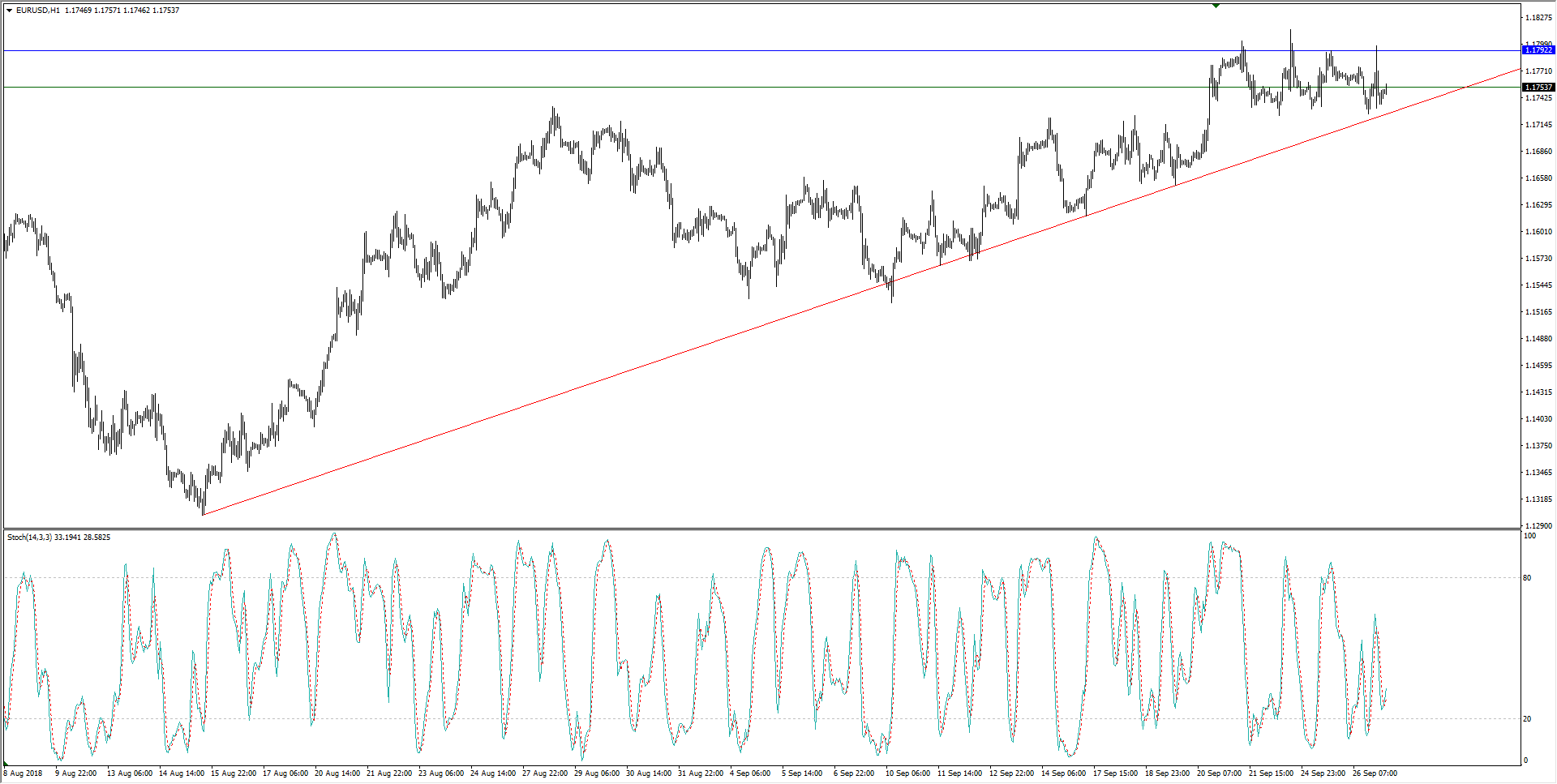

- The EUR/USD couldn’t find the momentum to break higher upwards following the US Federal Reserve’s 25 basis point hike on Wednesday, and the Euro remains trapped near 1.1750 as the week’s sideways range continues, with the pair’s swing lows regularly testing below 1.1730 with little follow-through.

- The current swing highs are marking out a horizontal resistance line nearby at 1.1790, and a rising trendline from August’s bottoms see the pair coming in to test a rising wedge, giving credence to a bullish breakout to come in the days to follow.

- Any potential upside could be limited, with slow Stochastics already marked in at overbought levels on Daily candles, though the fast MA is set to make another break above the slow MA.

| Spot rate | 1.1753 |

| Week change | 0.10% |

| Previous week high | 1.1802 |

| Previous week low | 1.1618 |

| Support 1 | 1.1726 (current week low) |

| Support 2 | 1.1721 (200-hour EMA) |

| Support 3 | 1.1656 (50-day EMA) |

| Resistance 1 | 1.1815 (current week high) |

| Resistance 2 | 1.1851 (June top barrier) |

| Resistance 3 | 1.1944 (200-day SMA) |