- The pair’s decline appears to have found decent contention in the 1.1360 region, where sits the key 200-week SMA.

- The leg lower in spot has been on the back of rising demand for safe haven currencies amidst swelling risk-off sentiment sparked by the crisis around the Turkish Lira (TRY).

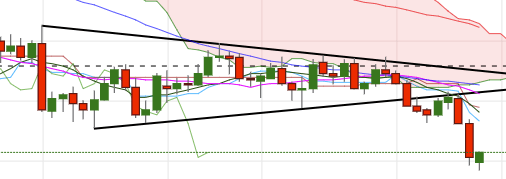

- Looking at the daily chart, EUR/USD resumed the downside following the 2-month consolidative theme and the subsequent breakdown of the pennant pattern.

- On the other hand, occasional bull runs should meet interim resistance at the 10-day SMA at 1.1563 ahead of the more relevant hurdle in the 1.1620/30 band, where converge the 21-day SMA, last week’s tops and the base of the daily cloud.

- In the broader picture, the offered stance should remain unchanged as long as the 1.1745/50 band caps.

Daily high: 1.1433

Daily low: 1.1365

Support Levels

S1: 1.1354

S2: 1.1297

S3: 1.1205

Resistance Levels

R1: 1.1503

R2: 1.1595

R3: 1.1652