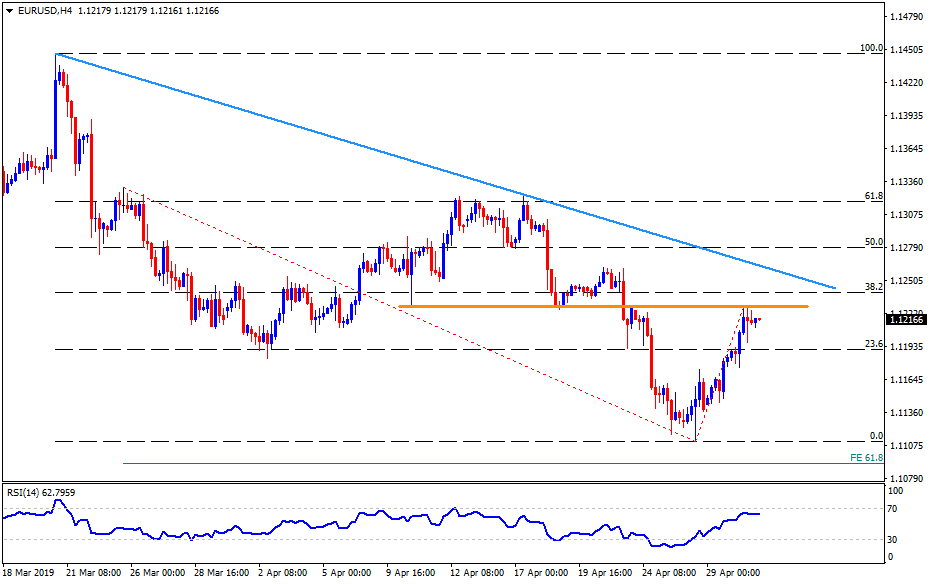

- A three-week long horizontal resistance favors the quote’s pullback to 23.6% Fibo.

- The descending trend-line since late-March seems important upside resistance.

Although gradual recovery from 1.1110 propelled the EUR/USD pair to a week’s high on Tuesday, the quote struggles to extend its upswing by trading around 1.1220 during early Wednesday.

At present, lows marked since April-start and a high on April 23 form immediate horizontal resistance around 1.1225/30, a break of which can help buyers to run towards six-week-old descending trend-line, at 1.1260.

In a case where prices rally past-1.1260, 50% Fibonacci retracement of March to April downturn, at 1.1280, followed by 1.1320-25 region including 61.8% Fibonacci retracement could lure bulls.

Alternatively, 23.6% Fibonacci retracement at 1.1190 could offer adjacent support during the pullback ahead of 1.1160.

Additional rests beneath 1.1160 are recent low near 1.1110 and 61.8% Fibonacci expansion (FE) level near 1.1090.

EUR/USD 4-Hour chart

Trend: Pullback expected