- EUR/USD steps back from two months high amid overbought RSI.

- Sellers will look for clarity as near-term key supports are still to conquer.

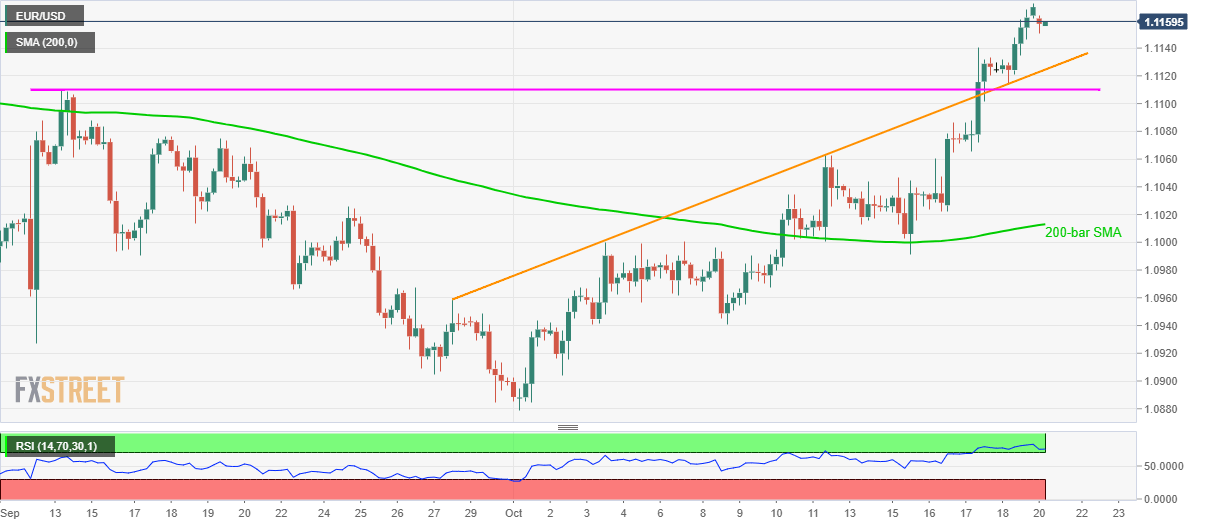

With the overbought conditions of the 14-bar Relative Strength Index (RSI) showing a lack of buying interest at the two month top, EUR/USD pulls back to 1.1160 by the press time of Asian session on Monday.

Even so, sellers are waiting for price decline below the three-week-old rising trend line, at 1.1125, followed by September high nearing 1.1110, in order to tighten their grip.

In doing so, 1.1075 and 1.1060 can entertain them ahead of highlighting the 200-bar Simple Moving Average (SMA) level of 1.1013.

Alternatively, recent high surrounding 1.1167 holds the key to pair’s run-up towards August month high surrounding 1.1250.

EUR/USD 4-hour chart

Trend: pullback expected