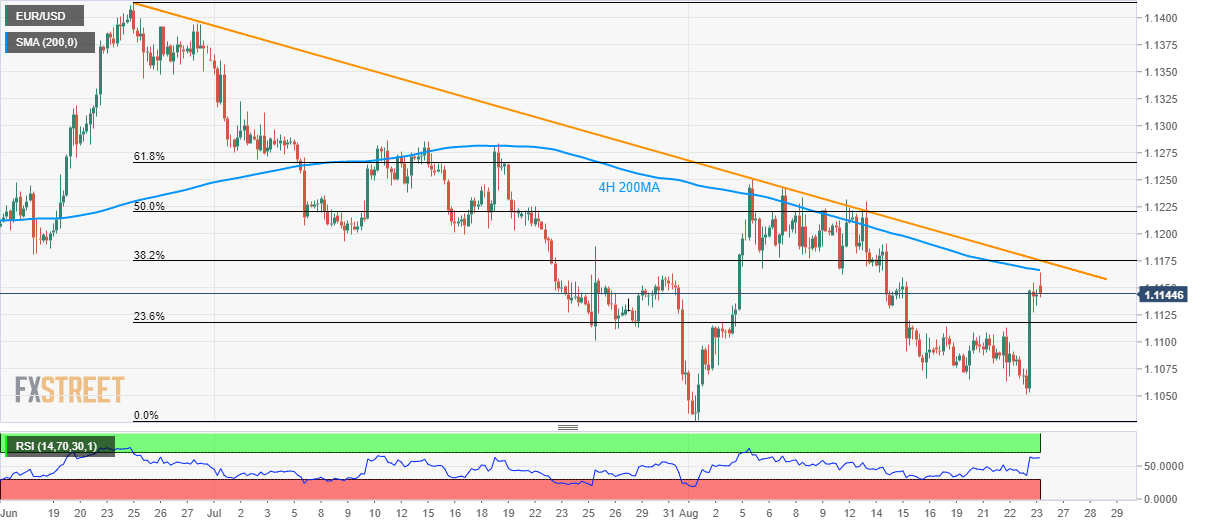

- EUR/USD remains on the back foot below 4H 200MA.

- Two-month-old trend-line, 38.2% Fibonacci retracement add to the resistance.

Following its run-up to eight-day high, the EUR/USD pair witnesses a pullback to 1.1144 during Monday morning in Asia.

The 200-bar moving average on the four-hour chart (4H 200MA), at 1.1166, acts as an immediate upside barrier for the pair, a break of which will confront another strong resistance comprising a downward-sloping trend-line from June 25 and 38.2% Fibonacci retracement level of June-end to early- August downpour near 1.1175/77.

In a case prices manage to stay strong beyond 1.1177, 50% Fibonacci retracement of 1.1221 and August 06 high near 1.1251 will please buyers.

On the downside, 1.1113/10 including August 19-22 tops holds the keys to pair’s further declines to last week’s low near 1.1050 and then to the monthly bottom surrounding 1.1027.

EUR/USD 4-hour chart

Trend: Bearish