- The German economy is still struggling despite green shoots.

- Growing political and economic pressure may push Merkel to announce fiscal stimulus.

- Green investment may be the way out of austerity.

- EUR/USD has room to rise if governments replace the ECB in the driver seat.

Germany has flirted with a recession in 2019 and prospects for 2020 are far from being encouraging. The old continent’s “locomotive” remains sick due to the global cooling off and the refusal of Berlin to budge. However, there are reasons to believe that Europe’s largest economy may change its ways.

How Germany has reached this point

Despite rising from the lows, Markit’s Manufacturing Purchasing Managers’ Index has been contracting throughout the year. The industrial downturn – which is already weighing on the still-growing services sector – is mostly a result of weaker demand from China, a result of the trade wars with America. Uncertainty about EU-US trade relations and Brexit have been also weighed on the euro zone’s largest economy.

These external factors have triggered the initial manufacturing downturn, but there is broad agreement that the lack of action from Berlin is contributing to the slump – especially the lack of investment. The German word Schuld means both debt and guilt – and it explains the aversion that Chancellor Angela Merkel’s governments have with lending in order to invest despite rising pressures to doing so. Officials have reiterated that the Schwarze Null policy – a minimal budget surplus – remains intact. The European Central Bank – located in the German city of Frankfurt – has been calling on all euro-zone governments to do more. However, this call has fallen on deaf ears, especially in Berlin.

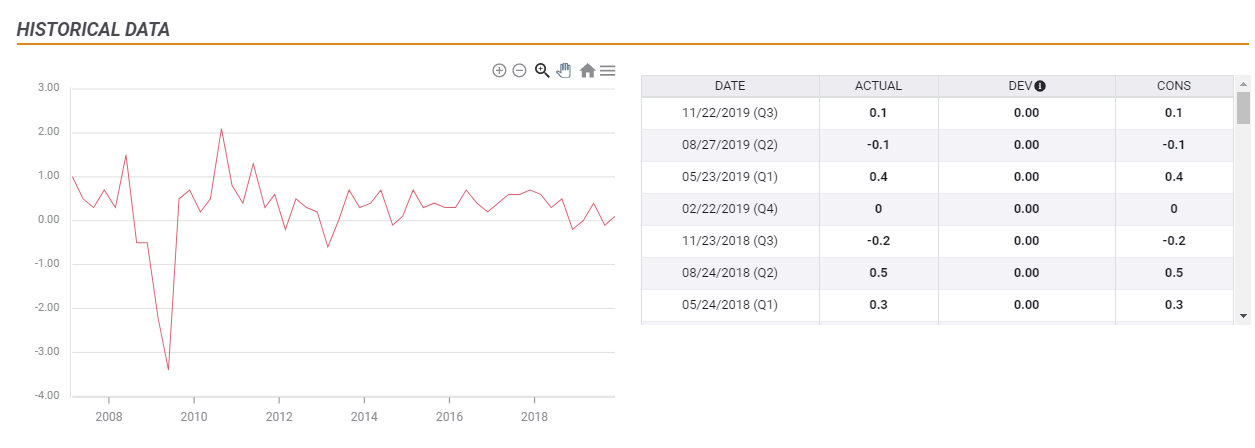

Germany Gross Domestic Product (QoQ)

Germany has barely escaped a recession in the third quarter of 2019 with a minimal growth rate of 0.1% after contracting by 0.1% in the second quarter. Moreover, unemployment has shown signs of picking up following long years of consistent declines.

From green shoots to green investment

As mentioned earlier, manufacturing contraction has slowed and Germany skirted an official recession. Several analysts fear that these “green shoots” may soothe Berlin and allow it to push back against calls to introduce fiscal stimulus.

However, the rising need for green investment may provide a panacea. The climate crisis has worsened in recent years with higher temperatures, fires, floods, and other phenomena which has become less rare than it used to. More importantly, environmental issues have been gaining more and more traction. School walkouts initiated by Greta Thunberg and other protests have placed green causes high on the agenda.

Specifically in Germany, the Green Party is on the rise and may surpass the center-left SPD as the second-largest political factor. They see the government’s recent climate package as insufficient and many citizens tend to agree with its popular leaders Annalena Baerbock and Robert Habeck. The latter is seen as Germany’s Emmanuel Macron.

The hope – for the environment, economy, and EUR/USD bulls – comes from Merkel’s famous willingness to adopt popular policies, often “stealing” them from her political rivals. Examples include making the SPD’s minimum wage demand her own, turning from supporting nuclear energy to shutting down plants, welcoming refugees with open hands before closing the doors.

If she moves toward more environmentally friendly policies, she may also convince the socialists to remain in her coalition. The new leadership of the party has been calling for greener policies.

Public investment in green technology and infrastructure would, therefore, achieve political goals. And, it may boost the domestic and European economies. For Merkel, it would also be easier to use green spending to abandon the constitutional debt-brake and finally loosen its purse strings.

End of austerity in Germany?

On spending, the German public – and therefore Merkel – are harder to convince. It would probably take a considerable rise in the jobless rate – currently at record lows of 5% despite the rise in the number of unemployed – to make it easier to accept taking on new debt. However, in addition to green necessities, external influence may also help.

The world is moving away from cutting budgets and caring about debt. In the UK, Prime Minister Boris Johnson distanced himself from his Conservative Party’s post-crisis austerity legacy and promised new investment in health and the police.

In the US, Republicans stopped talking about deficits once they reached power. Moreover, the world’s largest economy has accelerated its debt undertaking despite 50-year low unemployment – without any public outcry.

Japan – always one step further – announced a new fiscal stimulus plan. The world’s third-largest economy has a debt-to-GDP ratio of over 200% and a jobless rate nearing 2%. Also there, lending money is not an issue.

Apart from overseas influence, pressure from the continent’s other large economies is mounting. The French economy is outperforming the German one as President Macron appeased the Gilets Jaunes protesters. Italy has a leftist coalition that wants higher spending, and Spain will soon have a government that includes the anti-austerity Unidas Podemos party. The European Commission is now led by Ursula von der Leyen, Merkel’s former defense minister. The two allies may push for a change in the whole continent. Brussels may now ease its requests for Spain and Italy, also allowing Germany to loosen its policy.

During the long years of austerity, Berlin relied on Frankfurt to provide stimulus. While the Bundesbank, Germany’s central bank, objected to the European Central Bank’s bond-buying schemes, the ECB received a quiet nod from Merkel. Former President Mario Draghi’s accommodative policies have lowered borrowing costs and increased confidence.

However, the central bank is reaching its limits. The deposit rate is at -0.50% and the bond-buying scheme may hit the self-imposed caps. If President Christine Lagarde were to allow unlimited buying of bonds held by debt-stricken countries such as Greece and Italy, northern members would likely rebel.

ECB Deposit Rate

While the ECB is doing “everything it takes,” it has also increased its calls on governments to do more amid its inability to help. That also adds pressure on Germany to act.

How and when will EUR/USD react to German stimulus?

A German change of heart may have an immediate effect on the euro. The mere announcement that Merkel is moving forward with green investment – or any other fiscal spending – would likely send the common currency surging.

How? Public investment would signal potential growth and trigger private expenditure. Stocks that would benefit from Germany’s plans would also see inflows, also boosting the euro.

Moreover, it would provide relief for the ECB. Markets would price out stimulus and begin speculating about when the ECB would raise rates and end its QE scheme.

European politics are slow, and it may take some time for Merkel to move. Opinion polls showing the rise of the Greens and the slide of her CDU party may push her to move earlier. A coalition crisis with the SPD could also accelerate the process.

But perhaps it would take further sluggish figures to move the dial. Gross Domestic Product figures for the fourth quarter of 2019 and the full year are due in February, but signs that the economy is going nowhere in 2020 could also help. It may take until May – when GDP statistics for the first quarter are due out – to convince Berlin to act.

Conclusion

The German economy continues struggling, dragging the rest of the continent down and weighing on the euro. External and internal pressures are mounting for the government to announce a fiscal stimulus to support the economy and to make a greater contribution to saving the planet. If such a move happens – perhaps in the first half of the year, the euro may leap.

-637136528021352697.png)