- EUR/USD loses further the grip and slips back to 1.1270.

- US targets tariffs on EU, UK imports worth around $3.1 billion.

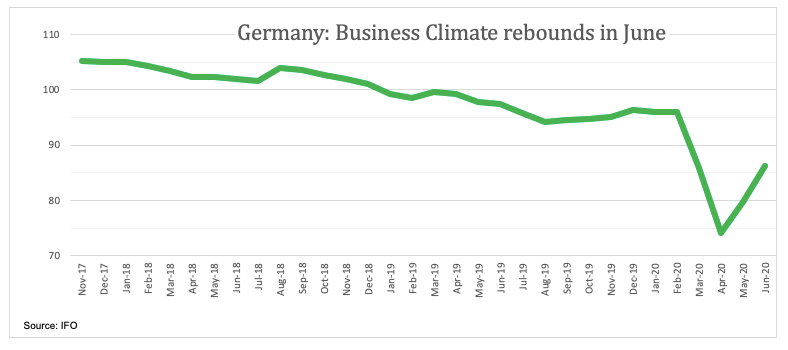

- German Business Climate rebounded further in June.

Following Tuesday’s uptick to the mid-1.1300s, EUR/USD is now fading part of those gains and recedes to the 1.1270 region, or fresh daily lows on Wednesday.

EUR/USD loses momentum near 1.1350

EUR/USD managed to advance to weekly tops in the mid-1.1300s on Tuesday on the back of positive data releases in the euro area, hopes of a strong economic recovery and generalized weakness surrounding the greenback.

However, news that the White House could announce tariffs on the UK and the EU (France, Spain and Germany) have been weighing on the pair’s price action and supporting the risk-off mood, which in turn helped the buck to regain some poise.

Earlier in the session, the German IFO survey showed a further improvement in the Business Climate, this time climbing to 86.2 in June (from 79.7).

Across the pond, MBA’s Mortgage Applications are due seconded by the EIA’s report on crude oil supplies and the House Price Index. In addition, FOMC’s C.Evans and J.Bullard are due to speak.

What to look for around EUR

EUR/USD appears to have met some important resistance in the 1.1350 region so far this week. In the meantime, investors continue to look to the gradual return to some sort of normality in the Old Continent as well as rising concerns over the probability of a second wave of coronavirus contagion. The constructive view in the euro, however, remains well sustained by the gradual and relentless re-opening of economies in Europe and by the ongoing monetary stimulus announced by the ECB, Germany and the European Commission. On top, the solid performance of the region’s current account is also adding to the attractiveness of the shared currency.

EUR/USD levels to watch

At the moment, the pair is losing 0.09% at 1.1297 and faces the next support at 1.1168 (monthly low Jun.19) seconded by 1.1147 (high Mar.27) and finally 1.1030 (200-day SMA). On the upside, a breakout of 1.1348 (weekly high Jun.23) would target 1.1422 (weekly/monthly high Jun.10) en route to 1.1448 (50% Fibo of the 2017-2018 rally).