- EUR/USD has been pressured despite Mid-East calm.

- Upbeat German figures fail to counter USD strength.

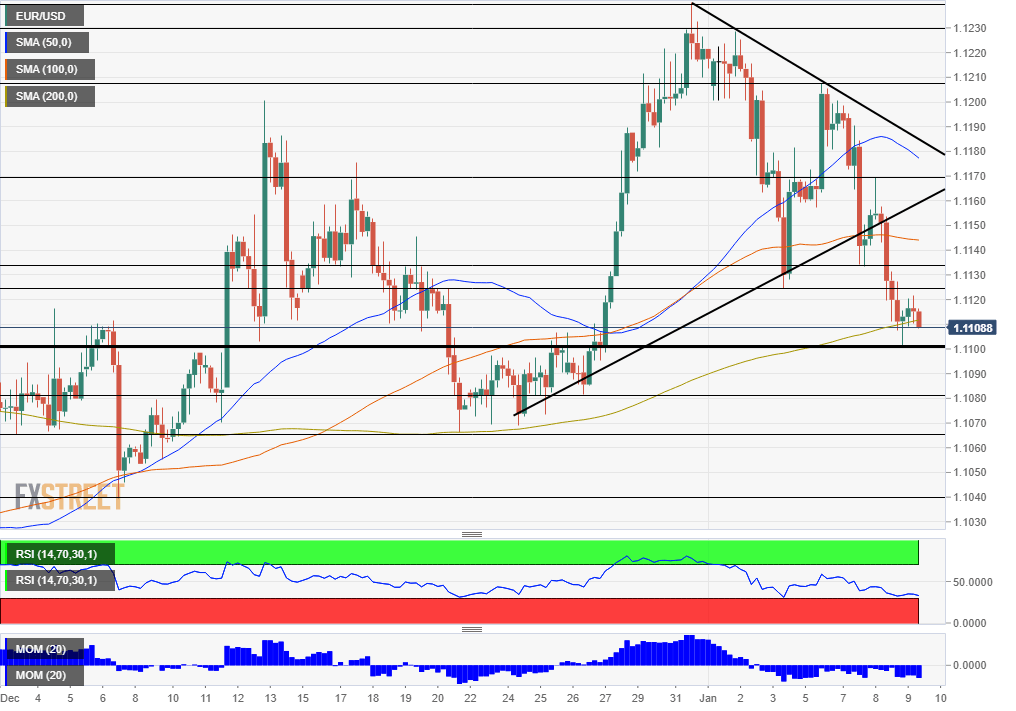

- Thursday’s chart is bearish after the pair fell below the wedge.

King Dollar reigns supreme – rising despite the significant easing of Mid-East anxiety. Safe-haven assets such as gold and the yen lost ground, but the greenback held its ground.

President Donald Trump has refrained from calling for a military response to Iran’s attack on American bases in Iraq. While he pledged more sanctions on Tehran, the president also offered an olive branch and called for new talks. Several Katyusha missiles fell on Baghdad’s fortified “Green Zone” on Wednesday. The incident – like the Iranian attack – probably ended without any damage.

The dollar is supported by US data. ADP’s private-sector jobs report showed a gain of 202,000 positions in December – better than expected and on top of an upward revision for November. Together with the upbeat ISM Non-Manufacturing Purchasing Managers’ Index, the mood around the world’s largest economy is positive. Investors are already eyeing Friday’s Non-Farm Payrolls report with elevated expectations.

China confirmed that Vice Premier Liu He will lead a delegation to Washington early next week to sign the Phase One of the trade deal. Investors are eager to see the details of the accord – trying to understand if this is only a temporary calm in the trade war or the dawn of a new relationship.

Back to normal?

In the old continent, German Industrial Production beat expectations with an increase of 1.1% in November. The euro’s failure to take advantage of the news and recover is telling – the common currency is exposing its weakness.

Eurozone unemployment rate and US jobless claims are of interest later in the day, but central bankers may steal the show. John Williams, President of the New York branch of the Federal Reserve, is one of several Fed speakers. Williams recently downplayed the chances of seeing higher inflation anytime soon – a dovish message – and markets will want to see if he reiterates this stance.

Jens Weidmann, President of the German central bank, will talk late in the day and may reaffirm his hawkish stance. The recent rise in headline inflation – to 1.3% yearly – may embolden Weidmann to call for refraining from additional stimulus.

Assuming no new hostilities, the Mid-East calm may allow for a return to normal market reactions – central bankers being the main market movers.

EUR/USD Technical Analysis

Euro/dollar has dropped below the wedge, or triangle, that had accompanied it in the past week. The currency pair also fell below the 100 Simple Moving Average on the four-hour chart and is struggling to hold onto the 200 SMA. Moreover, momentum is to the downside.

Overall, bears are in control.

Significant support awaits at 1.11, which is the daily low and a round number. The next line to watch is 1.1080, a stepping stone on the way up around Christmas. It is followed by 1.1065, a support line from that time. It is followed by 1.1040, which dates back to early December, and then by 1.10.

Resistance awaits at 1.1125, which was a swing low last week. It is followed by 1.1135, a support line seen earlier this week, and then by 1.1170, a swing high. 1.1205 and 1.1230 are next.