- The pair flirts with session lows near 1.1180.

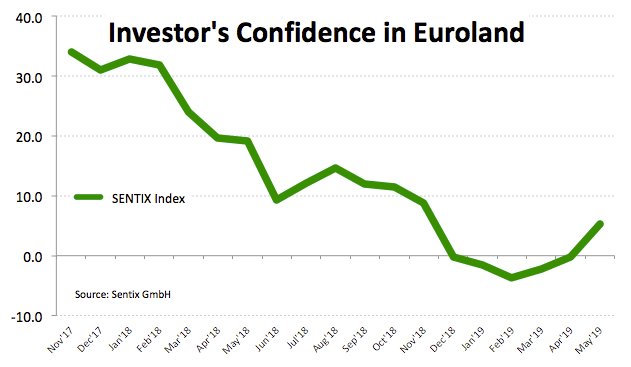

- Sentix turned positive for the current month.

- EMU Retail Sales surprised to the upside in March.

The offered bias around the European currency remains well and sound at the beginning of the week, with EUR/USD now trading closer to daily lows in the 1.1180/70 band.

EUR/USD negative despite data

Spot has resumed the downside on Monday, giving away part of Friday’s advance following the publication of US Non-farm Payrolls, which despite showing a solid job creation, wage inflation pressure failed to gather serious traction.

EUR stays on the defensive today on the back of the re-emergence of trade jitters on the US-China trade front and comments by President Trump.

The pair stays apathetic despite the Sentix index, which measures investors’ confidence in the euro bloc, improved to 5.3 for the month of May. In the same line, Retail Sales in the region came in flat on a monthly basis in March (vs. a forecasted 0.1% drop) and expanded 1.9% from a year earlier, bettering expectations.

Moving forward and in the US docket, Philly Fed P.Harker (2020 voter, hawkish) will speak on Economic Outlook ahead of the releases of Producer Prices and the CPI later in the week.

What to look for around EUR

Recent data in Euroland and Germany allowed market participants to believe that some healing process could be under way in the region amidst the ongoing slowdown. However, this scenario needs confirmation in the next months, while the current ‘neutral/dovish’ stance from the ECB is expected to persist for the reminder of the year and probable H1 2020. The broad-based risk-appetite trends and USD-dynamics are posed to rule the sentiment surrounding the European currency for the time being, all in combination with the onoging US-China trade dispute and potential US tariffs on EU products. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections in late May, as the populist option in the form of the far-right and the far-left movements appears to keep swelling among voting countries.

EUR/USD levels to watch

At the moment, the pair is losing 0.11% at 1.1188 and faces the next support at 1.1109 (2019 low Apr.26) seconded by 1.0839 (monthly low May 11 2017) and finally 1.0569 (monthly low Apr.10 2017). On the other hand, a break above 1.1264 (high May 1) would target 1.1271 (55-day SMA) en route to 1.1323 (high Apr.17).