- The weekly leg higher in EUR/USD stalled around 1.0960.

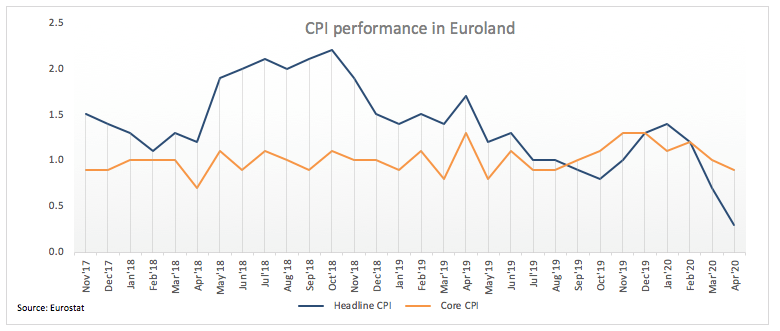

- EMU’s final April CPI came in at 0.3% MoM and 0.3% YoY.

- FOMC minutes next of relevance in the US calendar on Wednesday.

The upbeat tone remains well and sound around the single currency on Wednesday, lifting EUR/USD to daily highs near 1.0960 before losing some upside traction.

EUR/USD keeps targeting the 1.10 level and above

EUR/USD is posting gains for the fourth consecutive session on Wednesday, managing to break above the recent multi-session consolidative theme in the 1.0800 neighbourhood and visiting the 1.0960/70 region so far this week, where the 100-day SMA offered some resistance so far.

As usual, the renewed weakness around the greenback allowed the pair to reclaim ground lost and re-focus its trade to the psychological 1.1000 mark ahead of the critical barrier at the 200-day SMA, today at 1.1014. This area of resistance is also coincident with May’s peak near 1.1020.

In the docket, final CPI results in the broader Euroland showed headline consumer prices rose at an annualized 0.3% during April, while prices excluding food and energy costs rose 0.9% over the last twelve months. Further data in the region noted the Current Account surplus shrunk to €27.4 billion in March (from €40.2 billion).

Later, the European Commission will publish its Consumer Confidence gauge for the current month. Across the pond, the FOMC minutes will likely be in the limelight laster in the NA session.

What to look for around EUR

EUR/USD has managed to retake the 1.0900 barrier and beyond amidst a strong selling bias in the buck and the generalized improvement in the risk appetite trends. In addition, better-than-expected results in Germany and the broader euro area have been also sustaining the strong rebound in the pair, which is now targeting the 1.10 barrier. In the meantime, the solid position of the euro area’s current account coupled with the gradual re-opening of the economy keep deeper pullbacks in the pair somewhat contained for the time being. Meanwhile, in the political scenario, the recent German court ruling against purchases of sovereign debt under the ECB’s QE programme threatens to widen the existing cracks within the euro area and could limit any serious recovery in the currency. This view has been also exacerbated after the French-German proposed fund to help economies to recover from the coronavirus fallout met resistance among some Northern-European members, namely the Netherlands, Denmark and Sweden.

EUR/USD levels to watch

At the moment, the pair is gaining 0.27% at 1.0952 and a break above 1.0976 (weekly high May 19) would target 1.1014 (200-day SMA) en route to 1.1019 (monthly high May 1). On the flip side, immediate contention emerges at 1.0774 (weekly low May 14) seconded by 1.0727 (monthly low Apr.24) and finally 1.0635 (2020 low Mar.23).