- EUR/USD keeps the negative footing near the 1.19 mark.

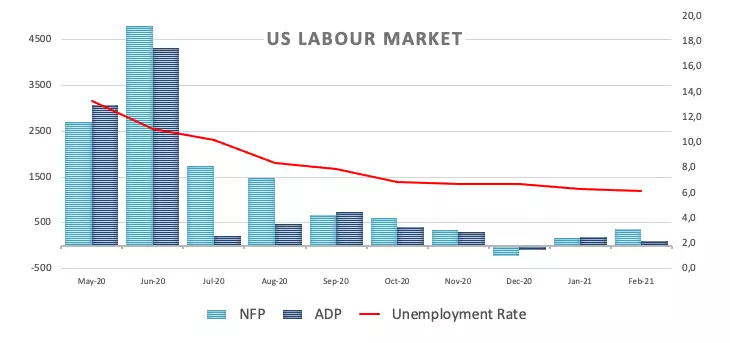

- US Non-farm Payrolls rose by just 379K jobs in February.

- The unemployment rate eased to 6.2%.

The selling interest around the single currency remains well and sound at the end of the week and drag EUR/USD back to the vicinity of the 1.19 hurdle in the wake of US NFP.

EUR/USD approaches 1.1900

EUR/USD keeps the negative stance on Friday after the US economy created 379K jobs during February, crushing estimates for a 182k gain.. The January reading was revised to 166K (from 49K).

Further data showed the jobless rate ticked lower to 6.2% (from 6.3%) and the critical Average Hourly Earnings – a proxy for inflation via wages – rose 0.2% MoM and expanded 5.3% over the last twelve months. Another key gauge, the Participation Rate, matched the previous reading at 61.4%.

Other than Payrolls, the final trade deficit came in at $68.20 billion for the month of January.

EUR/USD levels to watch

At the moment, the index is retreating 0.53% at 1.1900 and faces the next support at 1.1887 (61.8% Fibo of the November-January rally) followed by 1.1808 (200-day SMA) and finally 1.1762 (78.6% Fibo of the November-January rally). On the flip side, a break above 1.2027 (100-day SMA) would target 1.2129 (50-say SMA) en route to 1.2243 (monthly high Feb.25).