- EUR/USD ended the week in red despite a bullish move on Thursday after US GDP.

- The weak US yields helped the Euro to regain some momentum.

- US NFP, Fed, and Eurozone economic forecast are the key events to watch next week.

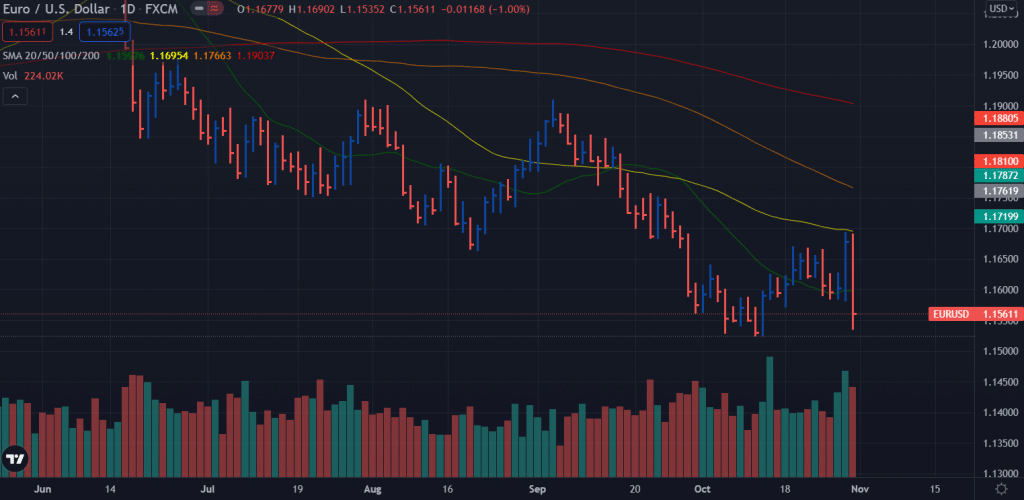

The EUR/USD weekly technical forecast is bearish as Friday saw a big dip towards the YTD lows where it found a little support.

After hitting a new October high of 1.1691 on Thursday, EUR/USD fell below the 1.1600 mark and posted fresh lows near 1.1560. Although mixed European performance and a flattening US yield curve have limited euro strength, the Euro has received some attention after the release of dire US growth figures and the ECB’s monetary policy announcement.

-Are you looking for automated trading? Check our detailed guide-

The long-term US Treasury yields started the week calmly and accelerated their declines several days later. Government bond benchmarks fell to 1.51% for 10-year bonds and rose above 0.50% for 2-year bonds. It also indicates a slowdown in economic growth when the spread narrows during a rate-hike cycle.

US bond yields are not the only ones that differ from those on long-term bonds. The situation is similar in Germany, the UK, Canada, and Australia, especially when comparing the yields of 5-year and 30-year bonds.

As a result of supply chain problems after the pandemic and high energy prices, central banks face rising inflationary pressures as the recovery loses momentum. But, as global policymakers have tried in vain to quell inflation fears, monetary tightening can be a double-edged sword.

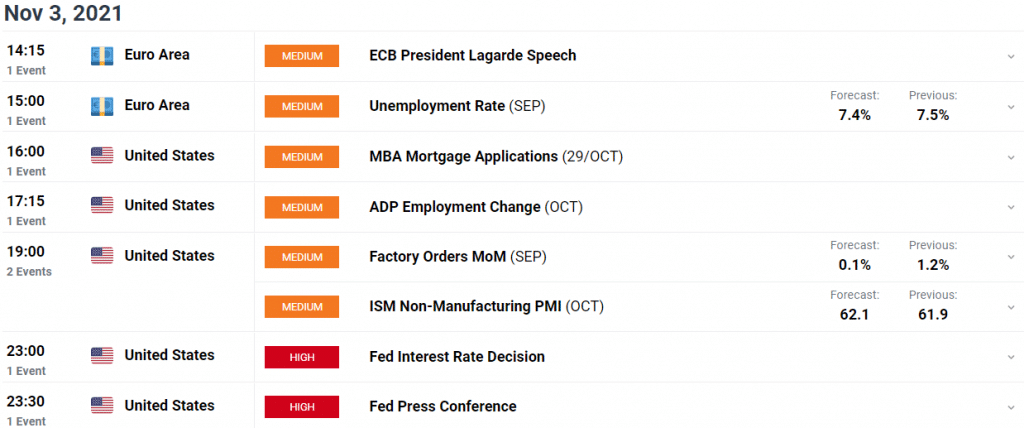

The ECB has held a meeting, the US Federal Reserve will do so next week, and the results will be announced on November 3. As expected, the European Central Bank left its monetary policy unchanged, while the accompanying statement was essentially unchanged from the previous one.

The press conference of President Christine Lagarde is in the spotlight. According to Lagarde, inflation is likely to be temporary and decline next year. However, when asked about what they were discussing these days, she answered “inflation, inflation, inflation,” which suggests that politicians are more worried than they seem. In October, the EU CPI reached a 13-year high of 4.1% y/y, while the CPI in Germany spiked to 4.6% y/y in the same month.

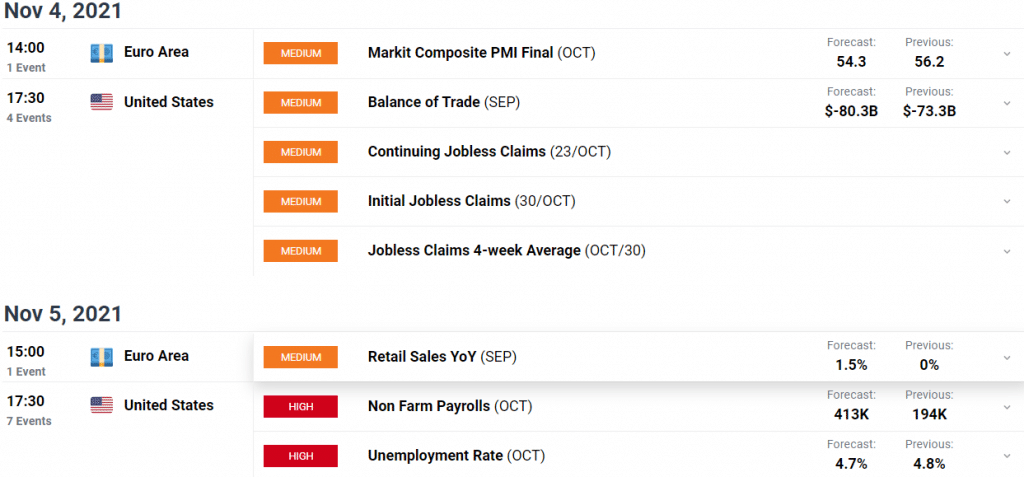

Key events/data for EUR/USD next week

Macroeconomic releases will be plentiful during the first week of November. The US will publish official data on the ISM PMI on Wednesday, with the industrial index expected at 60.4 and the services index at 61.5, slightly below September. In addition, the US Federal Reserve will announce its monetary policy decision on Wednesday.

– If you want to find out more about MT4 forex brokers, read our comprehensive guide –

In addition, the US will publish its October Nonfarm Payroll Report. The country is forecast to create 385,000 new jobs in October, up from 194,000 in September, and the unemployment rate will remain unchanged at 4.8%.

The German economy will be assessed by the release of retail sales, factory orders, and industrial production numbers in September. In addition, the European Union will focus on the European Commission’s economic growth forecasts and retail sales for September.

EUR/USD weekly technical forecast: Bears to mark fresh lows

Thursday’s positive price action was all swept by Friday’s sudden downside move. The bears paused just above the YTD lows and closed the week in red around 1.1560. The price found a strong rejection at 50-day SMA. The price is now well below the 20-period SMA, which is another bearish sign. We can expect a test of YTD lows at 1.1520 ahead of 1.1500. On the upside, 1.1600 will be the key resistance ahead of 1.1660.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.