- EUR/USD’s trading has been dominated by the ebb and flow of US yields.

- The ECB’s decision, Biden’s inauguration, and coronavirus developments are eyed.

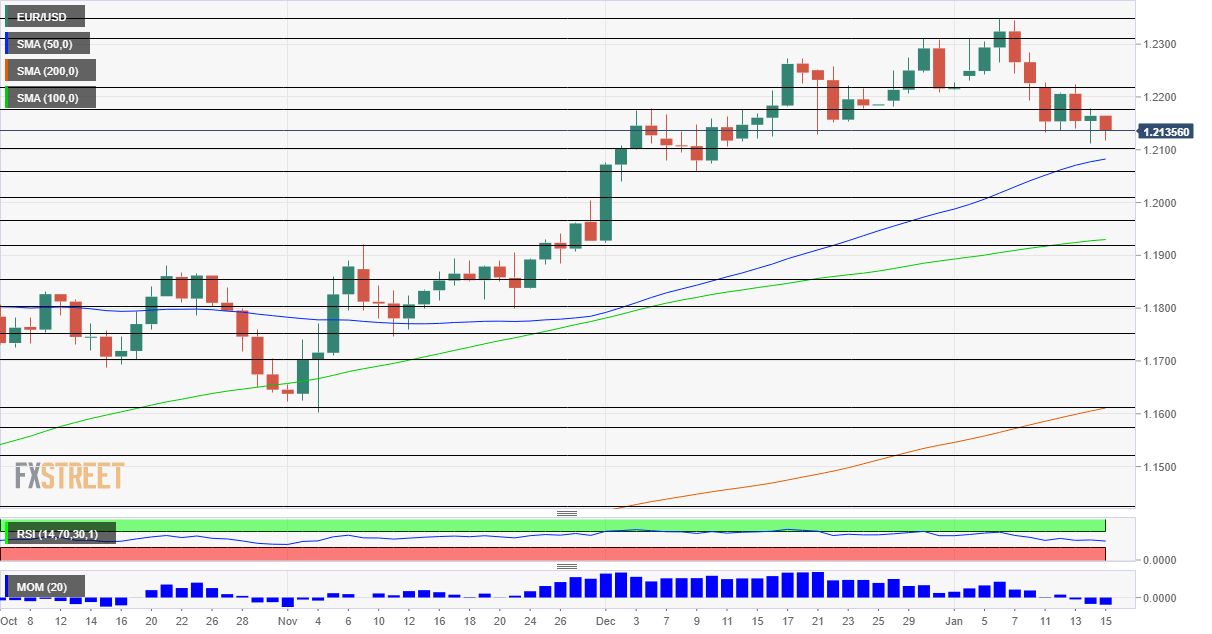

- Mid-January’s daily chart is painting a mixed picture.

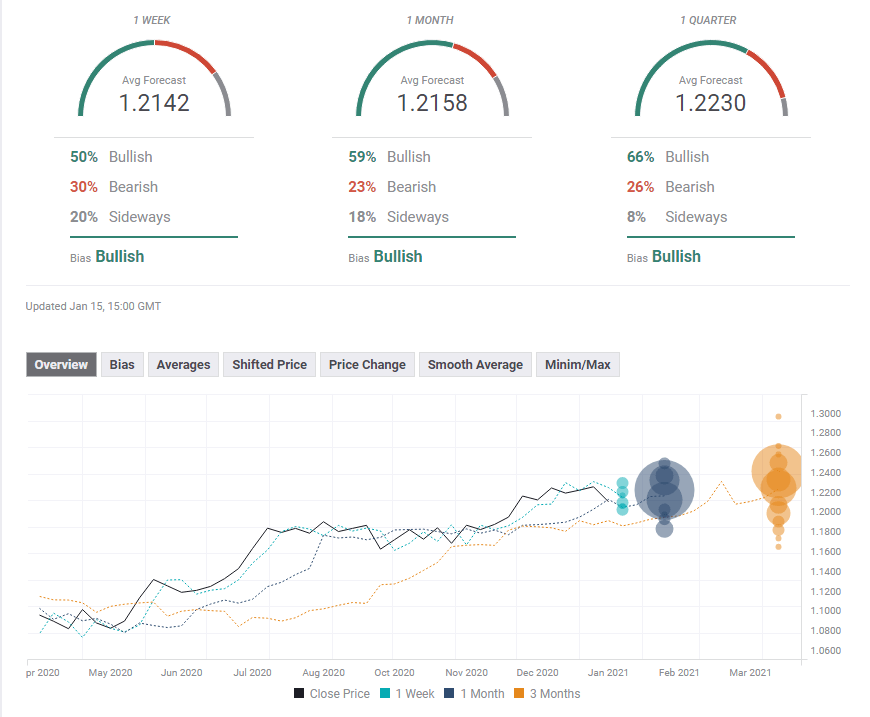

- The FX Poll is pointing to gains on all timeframes.

To taper or not to taper? That has been the question for the Federal Reserve amid the new administration’s massive spending plans. President-elect Joe Biden’s inauguration is set to prompt fast action, while the European Central Bank’s views will try not to rock the boat. The virus/vaccine tug of war continues, and a look into the post-Merkel era is also set to move the euro.

This week in EUR/USD: Moving to the tune of yields

Biden is set to go big – the President-elect’s scope for spending is around $1.9 trillion, which means issuing more debt. Investors continued moving away from bonds, pushing Treasury yields higher and supporting the dollar. On the other hand, robust demand for US Treasuries halted the rally in returns and weighed on the greenback.

The US currency also received an initial boost from the Federal Reserve. Officials denied that they intend to taper their bond-buying scheme – but merely talking about rosier forecasts supported yields and the greenback. Jerome Powell, Chairman of the Federal Reserve, seemed to put an end to speculation by rejecting any tightening in the foreseeable future.

Powell’s cautious speech came after US jobless claims badly disappointed with a leap to 965,000, showing the need for further support. Treasury yields dropped in response to both events.

Retail Sales provided another bitter downfall, tumbling by 1.4% in December – and on top of downward revisions. In response, the dollar turned back to its role as a safe-haven and advanced.

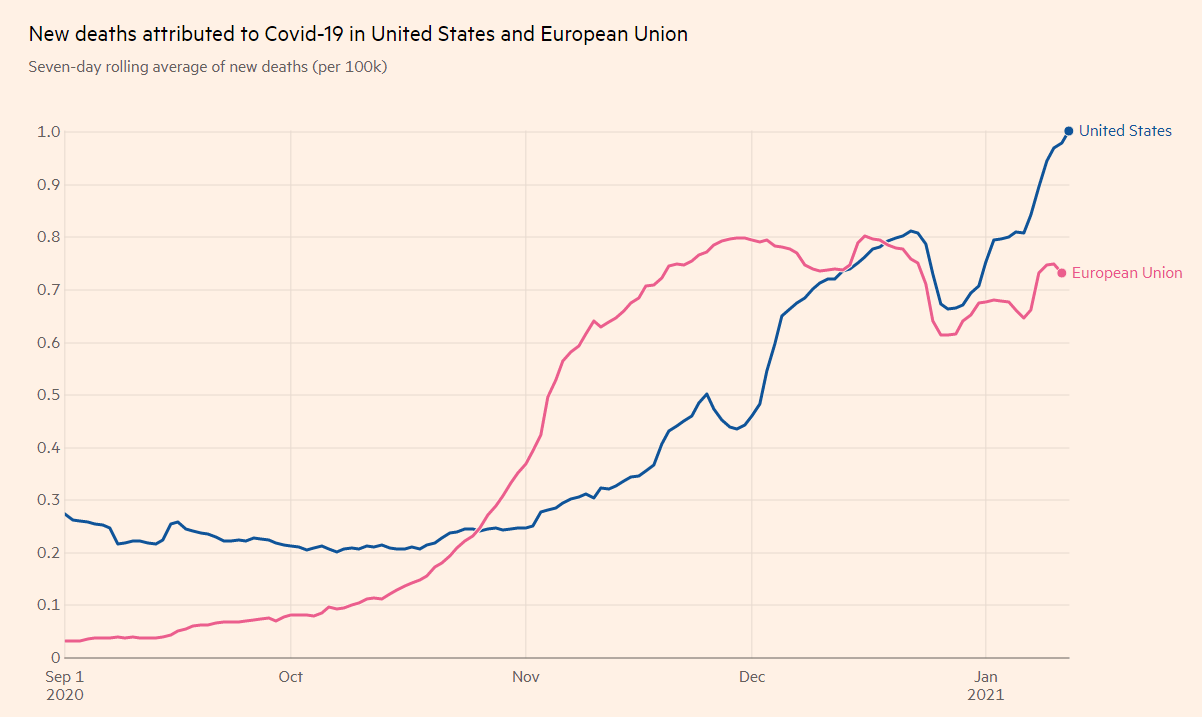

In the meantime, coronavirus has continued raging on both sides of the Atlantic. The US daily death toll advanced after surpassing the 4,000 mark, while Germany extended its lockdown amid rising mortalities and no relenting in infections.

Source: FT

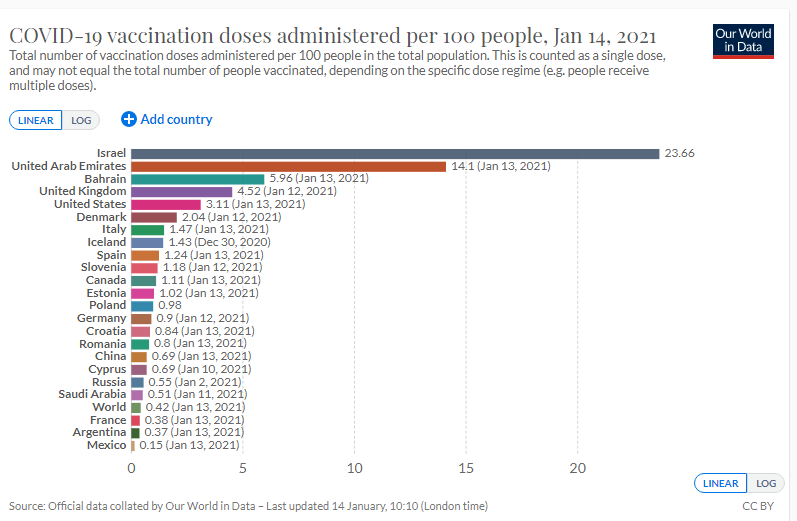

However, while the disease is taking its toll, there is a yawning gap in the vaccination pace. European countries have barely inoculated 1% of the population while America has surpassed the 3% mark and is accelerating its pace. The growing gap also weighs on EUR/USD.

Hope comes from Israel, the world’s leader in vaccinations, where an initial study showed that the Pfizer/BioNTech jab reduces infection, not only prevents disease.

Source: OurWorldInData

The common currency is receiving no help from a political crisis in Italy. Former Prime Minister Matteo Renzi abandoned the government led by Giuseppe Conte, leaving it without a majority. Markets have been shrugging off this development as all sides say they want to prevent unnecessary elections in the middle of a pandemic.

The German economy shrank by around 5% in 2020, according to initial estimates, and probably stalled in the final three months of the year. Investors are worried about a double-dip recession in the old continent.

US data has also shown that contrary to hopeful expectations, the present is gloomy.

Eurozone events: ECB, Merkel’s successor, and vaccines

Who will replace Angela Merkel as the most powerful politician in Europe? The race to succeed Germany’s Chancellor begins over the weekend, when her CDU party uses a secret ballot to elect a new person to lead the party toward the general elections in September.

Armin Laschet, who leads the state of North Rhine-Westphalia, is considered the continuation candidate who would extend Merkel’s cautious and pro-European approach. His main rival is Friedrich Merz, who is more popular among the wide membership and would lead the party toward a more populist right.

The euro would get a bump higher if Laschet wins among the 1,000-strong CDU bigwigs, and it would decline if Merz takes the helm. Norbert Röttgen, the third candidate, is seen as having little chance, but he is more in line with moderate Laschet than Merz.

It is essential to remember that Merkel’s previous elected successor, Annegret Kramp-Karrenbauer, eventually quit – and the party might still replace its leader until September. Moreover, while the center-right CDU/CSU bloc is on course to head the next government, voters have plenty of time to consider other parties.

See German Election 2021: Transitioning to the post-Merkel era and what it means for the euro

Frustration with the slow pace of vaccinations may lead the government to accelerate their distribution – and perhaps pressure the European Medicines Agency to greenlight AstraZeneca’s jab. Approval is likely at the end of the month.

Any increase in immunization and a decrease in the continent’s dire covid statistics would support the common currency. However, infections, hospitalizations, and deaths will likely remain elevated in the wake of the holiday season.

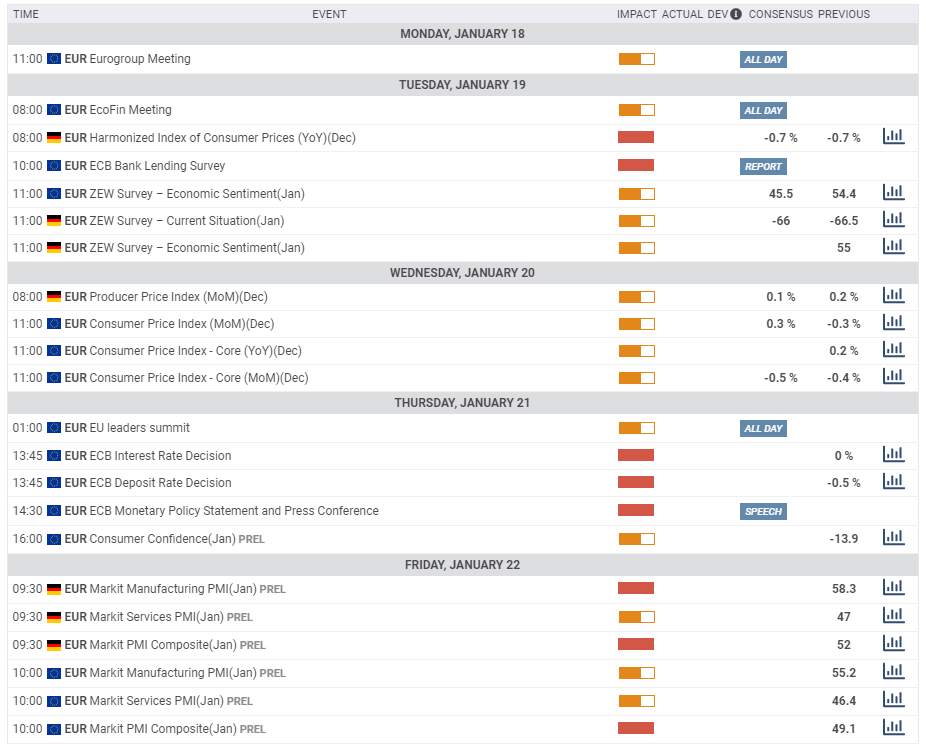

The economic calendar is busier than in previous weeks. Germany’s ZEW survey is set to show that the current situation remains depressed but that investors are optimistic about the post-pandemic era.

The main event of the week is the European Central Bank meeting on Thursday. The Frankfurt-based institution will likely leave its policy unchanged after increasing it by €500 billion in December.

Contrary to the pre-pandemic logic, printing more money is seen as positive for the economy and, therefore, the currency. If the ECB hints at another expansion, it would be positive for the common currency. However, if the bank’s solution to subdued inflation – core levels hovering around zero – is further cutting rates, EUR/USD could drop.

ECB President Christine Lagarde has recently said that there is less uncertainty after Brexit, the US elections, and the rollout of vaccines – and she will likely remain cautiously optimistic in the press conference. The bank publishes new forecasts in March, and that is when a policy change could occur if needed.

Last but not least, Markit’s preliminary Purchasing Managers’ Indexes for January will likely show further deterioration in the services sector – worst hit by the lockdowns. Investors will be looking for signs of hope – seeing beyond the current hardship.

Here are the events lined up in the eurozone on the forex calendar:

US events: Beginning of the Biden era

Investors have shrugged off the mob takeover of the Capitol and Trump’s impeachment for incitement of insurrection – but will they tolerate more violence? Supporters of the outgoing president are planning events around the January 20 inauguration of President-elect Joe Biden. As long as massive security measures hold up, the focus remains on what the incoming administration does.

Biden has already presented the scope of his economic plan, and investors will be tuned to how much of it will turn into reality. While the new occupant of the White House said that “everyone must pay their fair share,” – sending markets lower – tax hikes are unlikely to show up, at least not in the first package.

Comments from moderate Senate Democrats such as Joe Manchin and Kyrsten Sinema wield substantial power with a 50-50 split in the upper chamber. Republican centrists such as Susan Collins and Lisa Murkowski may also impact the final details of the plan.

In his first days in office, the new Commander-in-Chief may be in a rush to sign executive orders. While most of them will likely be unrelated to the economy – or unsurprising to investors – Biden’s first moves will be closely watched.

One reportedly policy decision would be to prioritize vaccinating more people at the expense of delaying the second shot. Markets would likely cheer any attempt to exit the pandemic earlier despite the risks associated with following an untested dosage path.

Immunization and coronavirus statistics remain of high interest – especially if governors impose new restrictions. The new president is set to call Americans to use face masks, but probably not make it mandatory.

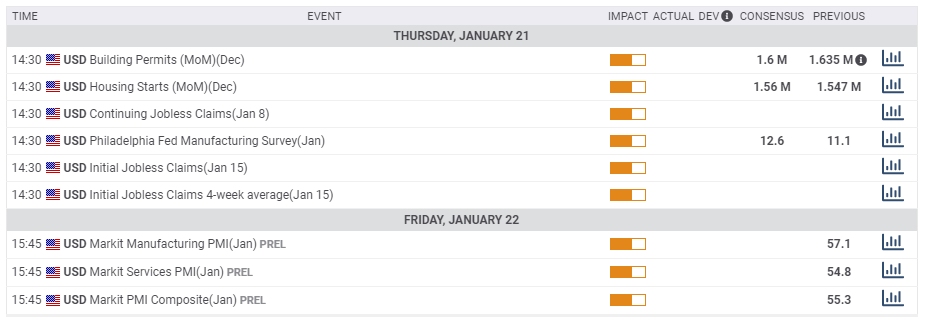

The US economic calendar is relatively light. Weekly jobless claims for the week ending January 15 may provide a sneak peek toward the Nonfarm Payrolls report, and Markit’s preliminary Purchasing Managers’ Indexes are also of interest.

Here are the scheduled events in the US:

EUR/USD technical analysis

Momentum on the daily chart has turned to the downside, but euro/dollar still trades above the 50-day Simple Moving Average and also the 100-day and 200-day SMAs. Bears are gaining some ground.

Support awaits at 1.2110, a low point in January, which replaces the former triple-bottom at 1.2125. It is followed by 1.2060, which was a stepping stone on the way up in mid-December. Further down, 1.2010 was a swing high in late 2020. It is followed by 1.1920 and 1.1860.

Resistance awaits at 1.2170, a swing high in mid-January, followed by 1.2220, a stubborn cap from the same time. The next noteworthy resistance line is only 1.2310, which was a peak around the turn of the year, and finally by 1.2350, the 2021 top.

EUR/USD sentiment

While the ECB may let go of moving the euro, Biden may make big statements and boost the dollar via yields. EUR/USD’s fall may be compounded by a growing immunization gap as well.

The FXStreet Poll is showing that experts are unconvinced by the recent dip, seeing consistent gains for the euro on all timeframes. The average targets have been revised to the downside, but only just.