- Both the ECB and the US Federal Reserve announced cuts in inflation-control measures.

- In the fourth quarter, macroeconomic data suggest that growth slowed more pronouncedly.

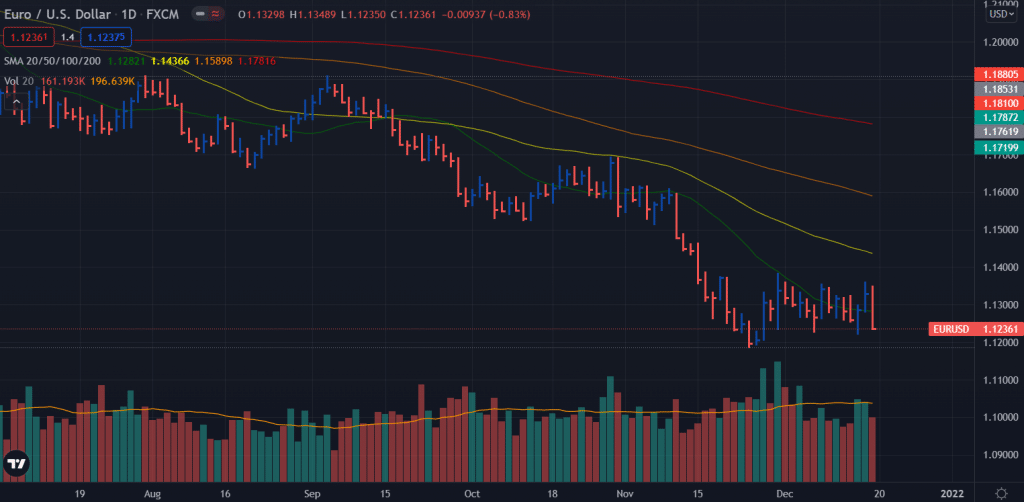

- While the risk is shifted downward, the EUR/USD is still consolidating.

The EUR/USD weekly forecast remains bearish biased as the pair shed off all the FOMC led gains and closed near the weekly lows.

–Are you interested to learn more about Forex apps? Check our detailed guide-

As the EUR/USD currency pair hovered around 1.1300 for a fourth straight week, modest gains were posted before the weekend, but no future is apparent. During this time of year, volatility is hit hard by the vacation depression, and the decline towards the end of the year can lead to odd pricing.

The US Federal Reserve and European Central Bank announced their monetary policy decisions last week and released new inflation and growth forecasts. As the markets waited for the release of the results, both central banks responded to the gradual decline in prices, which did not result in any directional movements.

Beginning in January 2022, the Federal Reserve will increase its monthly bond purchases to $ 30 billion from $ 15 billion previously. As a result, the central bank will stop buying government bonds and mortgage-backed securities every month, which means a faster rate hike. The Fed’s scatter chart currently predicts three rate hikes in 2022 and three more in 2023.

Forecasts for 2021 and 2022 have been raised to 5.6% and 2.6%, respectively, from 4.2% and 2.2%. As a result, GDP will grow by 4% in 2022, up from 3.8% in September, while the economy is projected to grow by 0.2% in 2023, up from 2.5 % in September.

In contrast, the ECB has confirmed that it will complete its pandemic emergency program in March 2022, as expected. Moreover, the governing council decided to increase its bond purchase program to €40 billion per month in the second quarter of 2022 and to €30 billion via PEPP in the third quarter.

Recent macroeconomic data confirmed inflation has reached an overheated level, and economic growth has slowed. The US PPI rose 9.6% year-over-year in November, while retail sales rose a modest 0.3%. Germany’s IFO business climate decreased to 94.7 in December, while the EU CPI rose 2.6% year-over-year in November.

Key data/events for the EUR/USD

US final GDP data for the third quarter and November durable goods orders for the EU will be released next week, and the US releases its consumer confidence data for December.

–Are you interested to learn more about STP brokers? Check our detailed guide-

EUR/USD weekly technical forecast: Bears threatening 1.1200

The EUR/USD price remains in a broad range. The attempt to rally remains bared by the upper band of the range around 1.1330. The volume data is also below average which shows further choppiness. However, the bearish bias is strong enough to threaten the 1.1200 mark as the price closed below the 20-day SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.