The European Central Bank convenes tomorrow. After this preview from Morgan Stanley, we have one here from Goldman Sachs:

Here is their view, courtesy of eFXnews:

For markets, this week’s ECB holds two questions.

First, will there be a formal taper decision. Second, if there is no formal announcement to this effect (our base case is for a continuation of the bond buying program at an unchanged pace through late 2017), is the backdrop to the Governing Council sufficiently caustic that President Draghi in the press conference essentially signals that a taper will soon be coming. We think markets will treat either outcome with little distinction. EUR/$ would go up, perhaps substantially.

Some have been discussing scenarios that aim to split the difference for the ECB, for example tapering purchases to a monthly pace of EUR 40-50 bn, but then extending the program for longer, say through Q1 2018. We think such proposals fail to take account of how skeptical markets have become where the ECB is concerned. After all, the December 2015 meeting and the misfire in March of this year have taught markets to be extremely skeptical as to the ECB’s willingness and ability to ease.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

As a result, we think markets will put more weight on the tapering signal, rather than any kind of program extension (which is subject to modification anyway).

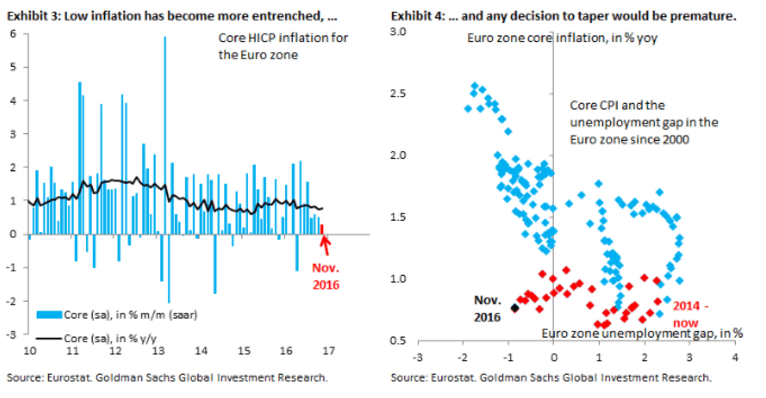

We think this is no time to taper, simply because of the challenging inflation dynamics in the Euro zone, in line with our European economics team’s assessment A premature taper, which a decision to this effect at this meeting would certainly be, will only complicate the ECB’s task of getting the Euro zone out of lowflation and fundamentally banishing deflation risk.