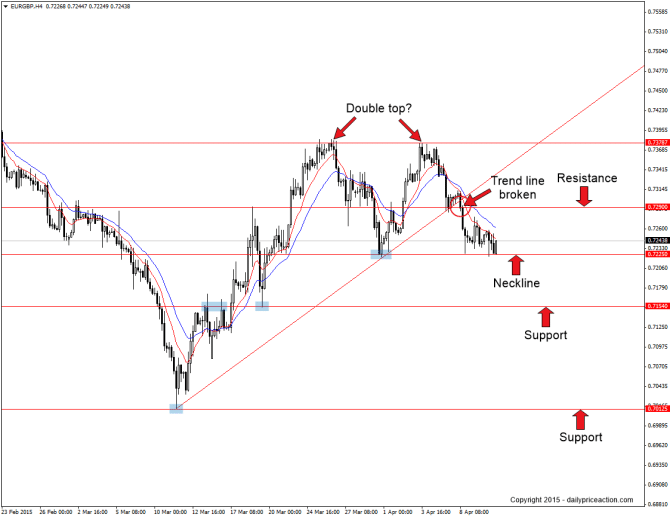

After losing more than 800 pips to start the year, EURGBP found relief on March 11th as the pair rallied 370 pips before finding resistance at .7290 in late March.

A second attempt at the level produced the same outcome in early April as the pair fell 150 pips and eventually found refuge at .7225.

Unlike the first rejection from resistance, the second move lower broke trend line support from March 11th. This break signaled weakness for the bears as they began to push the pair toward .7225 once more.

A look at the 4 hour chart over the past month tells the story. We have a potential double top between March and April along with neckline support coming in at .7225.

I say “potential” double top because this pattern has yet to be confirmed. For that we need to see a 4 hour close below the neckline at .7225. Only then can we begin watching for a retest of .7225 as new resistance.

That said, I’m also not opposed to selling this market at .7290 should the bears back off some to start the week. But for that I will need to see some form of bearish rejection of .7290 on a 4 hour basis.

Support levels below the neckline come in at .7154 and of course the multi-year low at .7012.

Summary: Wait for a 4 hour close below .7225 and then watch for a retest of the level as new resistance. Alternatively, a retest of .7290 as resistance combined with bearish price action could present a favorable selling opportunity. Key support comes in at .7225, .7154 and .7012.

Guest post by Justin Bennett of dailypriceaction.com