The Euro traded lower recently against the Japanese yen and tested the 130.60 support area where it found buyers. There was a major released lined up in Japan, as the Gross Domestic Product, which represents the monetary value of all the goods, services and structures produced in Japan was released by the Cabinet Office. The outcome was a bit higher than the market’s expectation, as the Japanese GDP gained by 0.4% in the fourth quarter of 2014, compared to the previous quarter of 2014. Moreover, the yearly change GDP was around 1.5%. The EURJPY pair was seen correcting higher after the release and currently heading towards an important resistance area.

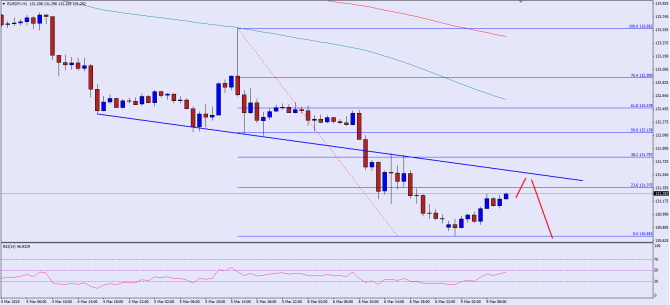

There was a crucial support trend line formed on the hourly chart of the EURJPY pair, which was breached by the Euro sellers. The pair is now moving back towards the highlighted trend line where it might find sellers. Initial resistance is around the 23.6% fib retracement level of the last leg from the 133.58 high to 130.69 low. However, a major barrier for the Euro buyers is around the broken trend line. One interesting point to note here is the fact that the hourly RSI is also approaching the 50 level, which means the pair is heading towards a pivot area in the near term.

If EURJPY pair fails to break higher and moves back lower, then initial support can be seen around the last low of 130.69. Any further losses might take it towards the 130.00 support area.

Overall, one might consider selling rallies in the EURJPY pair as long as it is trading below the broken trend line.

————————————-

Posted By Simon Ji of IKOFX Technical Team: Online Forex Broker

Website: http://ikofx.com/

In the fresh podcast, we talk about the US economy, the Australian and Canadian rate decisions, a potential easing in Japan, the widening gap within oil prices and an update on forex brokers after the SNBomb

Follow us on the iTunes page