The Euro fell sharply recently against the Japanese yen, and tested the 127.20 support area. It looks like consolidating as of writing and setting up for the next move. Earlier during the Asian session, the Japanese new orders report representing the total value of machinery orders placed at major manufacturers in Japan was released by the Cabinet Office.

The outcome was just above the forecast as it registered a decline of 0.4% in March 2015, compared to the preceding month whereas the market was expecting -2.8%. There was not much reaction from the Japanese yen pairs, instead the USDJPY pair was seen trading higher. In the Euro zone today there are a few releases, which might ignite moves in EURJPY.

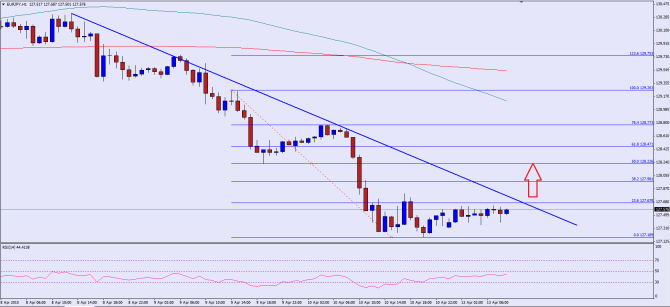

There is a critical bearish trend line formed on the hourly chart of the EURJPY pair, which is acting as a pivot area for the pair. It prevented upside on many occasions, and the pair is again heading towards it. However, looking at the current consolidation pattern and price action, there is a chance that the pair might break the trend line. The 23.6% fib retracement level of the last leg from the 129.26 high to 127.18 low is also sitting around the same trend line. So, a double break above the 23.6% fib level might ignite more gains in the near term, which could take EURJPY towards 128.20.

If the EURJPY pair fails to break higher and moves lower, then a break below the recent low might take it towards 127.00.

Overall, one might consider buying with a break above the trend line in the EURJPY pair as long as it is above the last low of 127.18.

————————————-

Posted By Simon Ji of IKOFX Technical Team: Online Forex Broker

Website: http://ikofx.com/

In this week’s podcast, we discuss: USDown or greenback comeback? And also touch other topics:

Subscribe to Market Movers on iTunes