The Euro managed to climb a bit higher against the US dollar, but failed to gain traction against the Japanese yen. The EURJPY pair traded lower and cleared an important support area, which might act as a catalyst for the pair for more downsides in the near term. The pair might continue to trade lower moving ahead and one could consider selling rallies. There were a couple of important releases in Japan recently, which missed the forecast. However, there was not much of an effect on the Japanese yen.

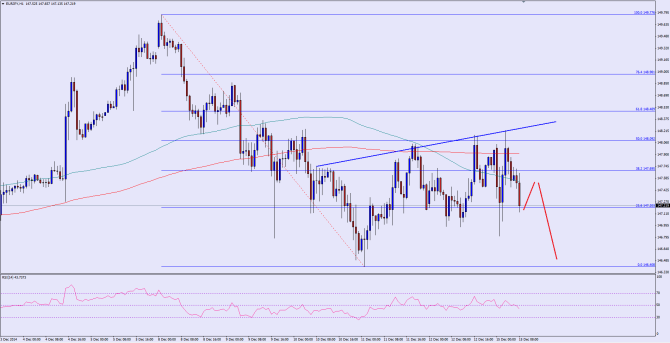

There is a bearish trend line formed on the hourly chart of the EURJPY pair, which acted as a resistance for the pair on a number of occasions. The pair has now settled below the 100 and 200 hourly simple moving averages, which might encourage the Euro sellers in the near term. We need to see how the pair reacts moving ahead, as there is a lot of bearish pressure on the pair, which could take it lower. The pair recently failed around the 50% fib retracement level of the last leg from the 149.77 high to 146.40 low. This is a critical bearish sign, which might take the pair lower if bears gain control. The hourly RSI has moved below the 50 level, which is one more bearish sign.

On the downside, the last low might act as a support for the pair around 144.40. A break below the same might take it lower towards the 140.00 support area.

Overall, one might consider selling rallies as long as the pair is trading above the 100 MA.

————————————-

Posted By IKOFX Technical Team: Online Forex Broker