EUR/USD is awaiting the verdict from the ECB. What will Draghi say? What will he do to the euro?

In the meantime, the team at BTMU assesses that euro sellers will emerge after position readjustment and explains:

Here is their view, courtesy of eFXnews:

The euro surged in August as the turmoil in global equity markets escalated, and this strength in part reflected safe-haven characteristics with the euro-zone current account surplus of over 2.0% of GDP providing investors with reassurance of stability during the period of risk aversion, notes Bank of Tokyo-Mitsubishi (BTMU).

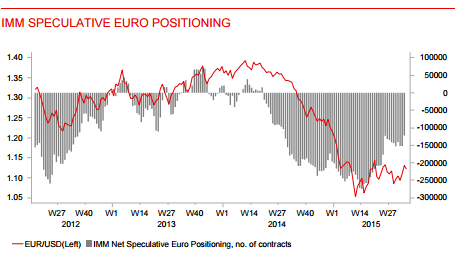

“However, the move was in our view more a reflection of positioning and the unwind of euro carry positions. The devaluation of the renminbi on 11th August may be encouraging the unwind of long CNY positions funded through the euro. Whether CNY positions or not, the IMM speculative positioning data indicated a large reduction in euro short positions in the week to 25th August, covering the period of extreme turmoil.

BTMU’s EUR/USD short-term valuation model implies that the EUR/USD spot close in August is about where it should be and once positioning becomes less supportive, the euro will start to trend weaker again.

Firstly, “the euro-zone economy is more vulnerable to the financial market turmoil and hence we suspect that expectations of additional ECB action may increase. ECB Vice President Constancio stated on 25th August that the ECB will not hesitate to act again if price stability is threatened,” BTMU argues.

Secondly, “reports that China may have spent USD 200bn defending the renminbi since the devaluation highlights the fact that global FX reserves are falling. While other EM countries are not spending nearly as much as China, the sharp depreciation in EM FX means declines in global FX reserves, which going forward may well result in these reserve holders selling the euro to maintain compositions,” BTMU adds.

BTMU targets EUR/USD at 1.06 by year-end and at 1.00 by end of Q2-16.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.