EUR/USD is scratching the highs every day, but still seems a bit shy of moving even higher. What’s next? Here is the view from Danske:

Here is their view, courtesy of eFXnews:

We expect the continued low inflation in the euro area to eventually trigger additional easing from the ECB, but we do not expect the ECB to address this by rate cuts. Instead, we find it likely the ECB will extend the QE purchases beyond March 2017, but believe this should not be announced in the near future.

According to the ECB, the closing output gap will support wage growth and hence core inflation, but so far the improved labour market conditions have not resulted in upward pressure on wages. Based on our detailed inflation forecast, we believe the ECB is too optimistic on its outlook for core inflation.

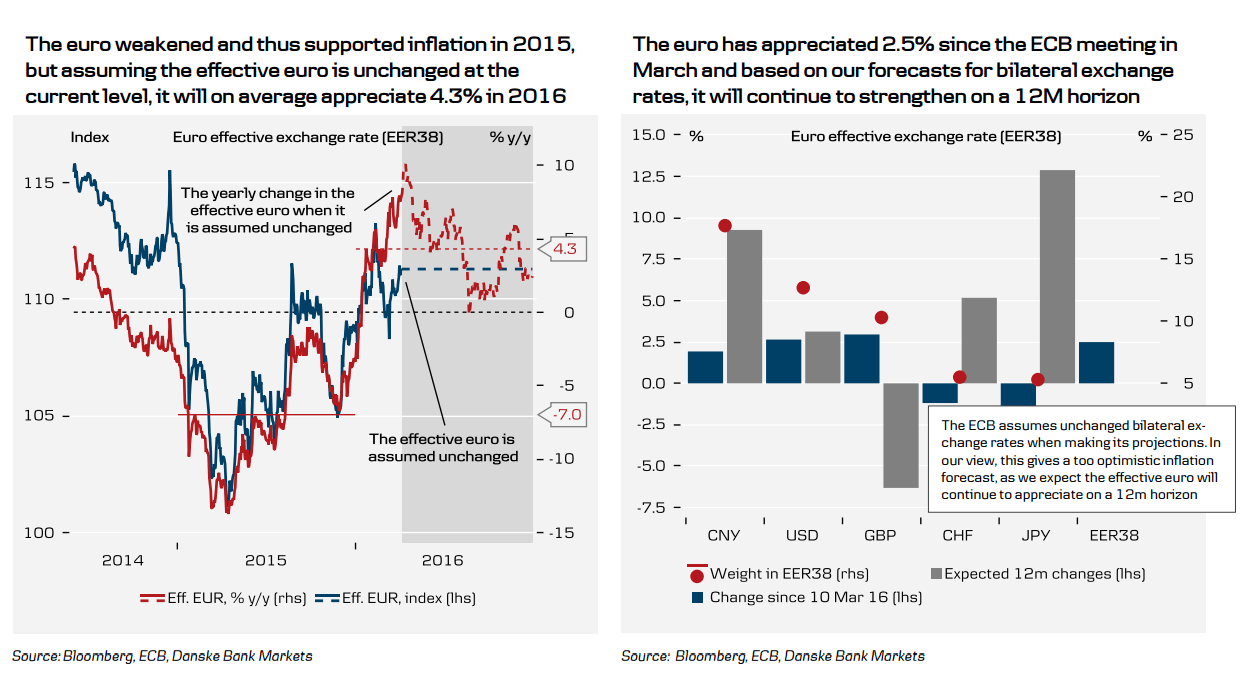

The biggest risk to our expectation that the ECB will not cut rates further is a strong appreciation of the effective euro. The effective euro has already appreciated 2.5% following the ECB easing in March and, based on our forecasts for bilateral exchange rate, the upward pressure on the currency is set to continue over the coming 12 months.

The stronger euro set to be a headwind to inflation. The ECB has made an alternative inflation forecast, where the effective euro gradually appreciates 5.5% towards 2018. It estimates that this on average will keep the euro area in deflation during 2016, while inflation will only reach an interval of 1.2-1.5% on average in 2018.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.