Technical Bias: Bearish

Key Takeaways

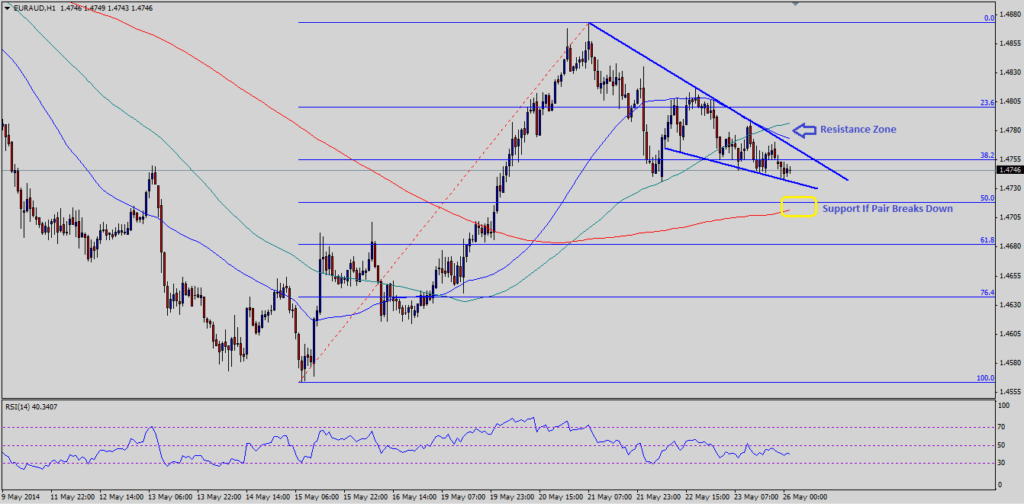

“¢ Euro is forming a critical short-term reversal pattern against the Australian dollar.

“¢ Market sentiment started to tilt in favor of the EURAUD sellers.

“¢ EURAUD support seen at 1.4720-00 and resistance ahead at 1.4760-80.

The Euro is heading towards a critical short-term break against the Australian dollar, as the market remains concerned ahead of the ECB policy meeting in June.

Technical Analysis

There is a crucial triangle forming on the hourly timeframe (not a perfect one) for the EURAUD pair. The triangle resistance lies at around 1.4760 level. However, the pair might find strong offers around an important confluence area of 50 and 100 hourly simple moving averages, which is just above the triangle resistance zone at 1.4780. If the EURAUD pair breaks the mentioned resistance zone, then it might call for further gains which could take the pair back towards the last high of 1.4870. Alternatively, if sellers take control and push the pair lower, then it might find buyers around 50% Fibonacci retracement level of the last leg higher from the 1.4564 low to 1.4873 high at 1.4720. This level also coincides with the 200 hourly SMA. So, if the pair breaks the triangle support area, then it might find bids around the highlighted support zone.

Hourly RSI struggles to go pass the 50 level, which is a warning sign, and any momentum loss could trigger a break in the pair. There is no major economic release scheduled during the London and the New York session, which means the pair might consolidate before heading in a particular direction.

It is worth mentioning that the Euro is trading around a critical support area against the US dollar as well, which means overall the shared currency remains vulnerable to most of its counterparts. If the Euro takes a hit, then it might also affect the market sentiment in the near term.