No surprises from the euro-zone inflation report: headline inflation stands at 0.6%, a small rise, yet as expected. Core inflation remains unchanged once again, sticking to 0.8% y/y.

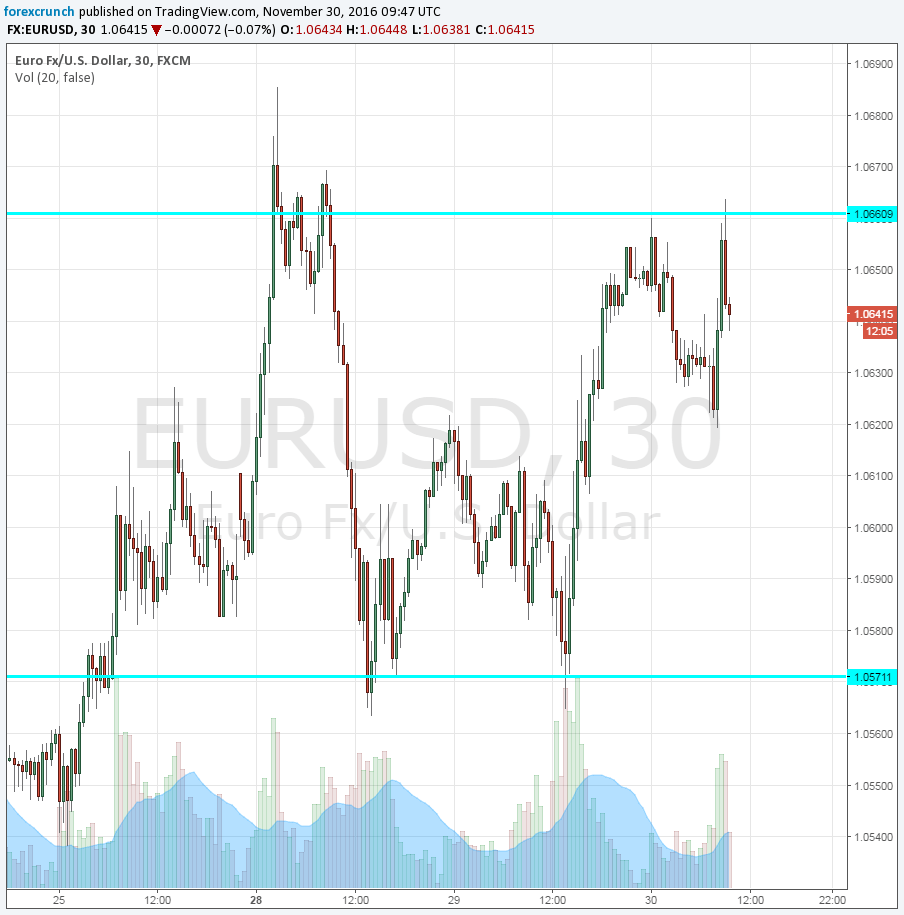

EUR/USD remains entrenched in range, around 1.0640. Resistance awaits around 1.07 and support at 1.0570.

The euro-zone was expected to report a tick up in headline inflation: 0.6% y/y in November after 0.5% in October. The upwards move is a result of the diminishing effect of lower oil prices seen last year. Oil prices are the center of attention also now, as OPEC convenes. Core inflation was predicted to remain unchanged at 0.8%, spelling further trouble for the European Central Bank.

Early reports from Germany were disappointing, but Spain’s inflation measures beat expectations. All in all, the data from the early reports did not skew the overall picture.

More: EUR/USD to 0.95 – echoes from Reagan

EUR/USD traded at the higher end of the range, around 1.0640.