Inflation is not going anywhere fast in the euro-zone: 1.5% y/y, standing in place. In addition, core inflation also slips to 1.1%, below predictions.

The drop in core inflation could push the European Central Bank to opt for a more moderate plan for tapering the bond-buying scheme (QE).

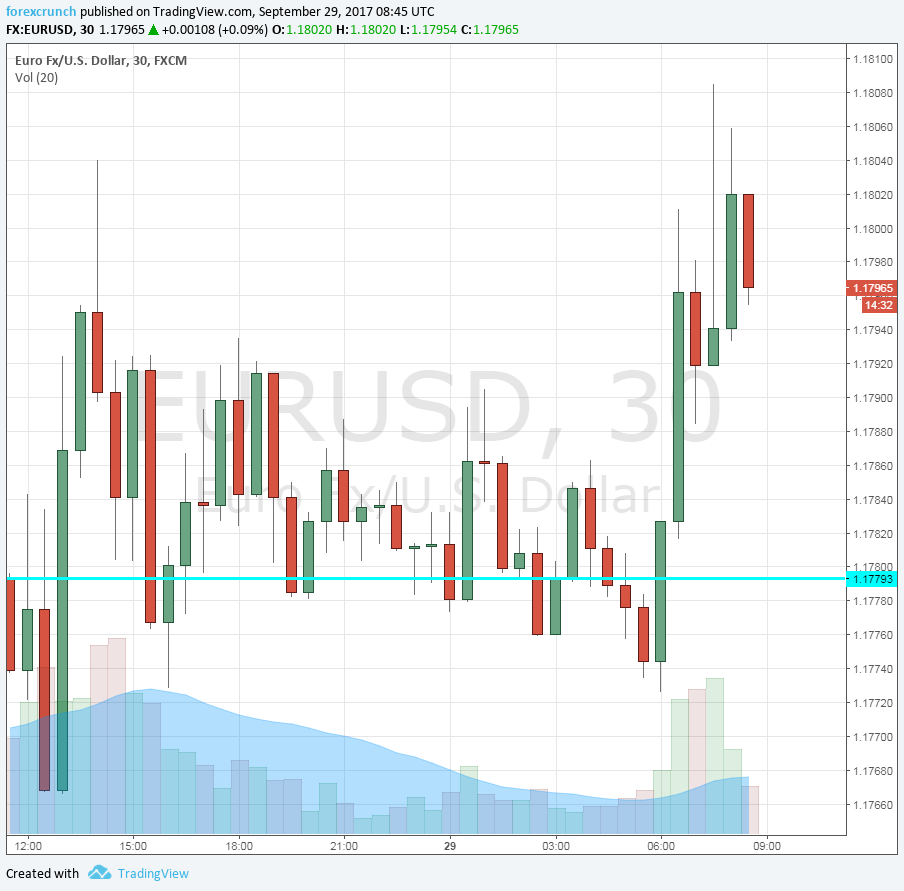

EUR/USD ticks down to 1.1789.

The preliminary inflation data for September was expected to show a small rise in y/y prices: 1.6% against 1.5% in August. Core inflation was forecast to remain unchanged at 1.2%.

EUR/USD was flirting with 1.18 ahead of the publication.

Earlier in the day, France released its own CPI estimate, and it showed a smaller than expected monthly drop of 0.1% instead of 0.2% predicted. Germany’s CPI, released yesterday, fell short of expectations. Spain’s numbers came out as expected.

The fall in euro/dollar was driven by the strength of the greenback. The tax reform proposed by Trump is one of the key reasons for the surge. In the old continent, the euro suffered from the results of the German elections: a fractured parliament that makes life tough for Chancellor Angela Merkel.

More: EUR: Less Favorable Outcome Of German Election EUR Negative But Downside Likely Limited – BTMU