No big surprises in euro-zone inflation: headline inflation continues rising, reaching 2% as expected. Core inflation remains stuck below 1%, with a third consecutive month at 0.9% y/y. PPI is up 0.7% m/m, above 0.6% expected. The unemployment rate is at 9.6%.

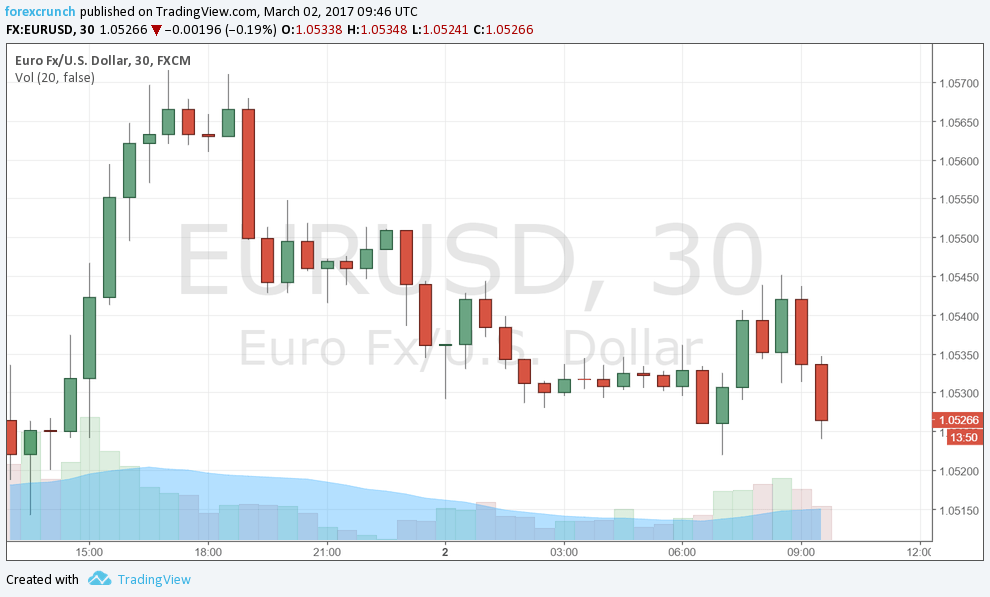

EUR/USD is marginally lower.

Euro-zone inflation was expected to move to a year on year level of 2%, bang on the ECB’s target. The headline CPI number stood at 1.8% back in January. Core inflation was projected to remain unchanged at 0.9%. At the same time, the unemployment rate carried expectations for remaining at 9.6%.

EUR/USD was on the back foot, mostly due to the Fed’s fresh hawkishness, and was around 1.0520. Further support awaits at 1.0460.

The sharp rise in headline inflation is correlated to the y/y jump in oil prices. The price of the black gold reached a trough around the beginning of last year. WTI Crude bottomed out around $26 in early 2016. The price is double now.

The data is key to the European Central Bank’s decision in one week from now. President Mario Draghi and his colleagues expected a rapid rise in inflation early in 2017. However, as they had ignored falling oil prices as a transitionary effect and watched out for any “secondary effects” that would cause toxic inflation, they also brush off rising inflation.

On the other hand, rising inflation, falling unemployment, and slightly stronger growth could eventually lift core inflation.

More: Currency of the week: EUR/USD: Cautiously optimistic as politics eyed [Video]