EUR/USD had its time in the sun, reacting positively to the FED decision. But the charm has faded, mostly due to a dollar comeback. The greenback remains the cleanest shirt in the dirty pile and the euro has few reasons to be cheerful.

Purchasing managers’ indices, which are forward-looking and try to predict future economic activity, have been released in their preliminary version for September. While they were not too bad, it is hard to say that they show prospects of a significant pickup for the euro-area.

Euro-zone PMIs

French manufacturing PMI rose from 48.3 in August to 49.5 in September. This is still below the 50 point threshold separating expansion and contraction, despite the positive surprise. The services sector looks much better with 54.1 points, a big jump 52.3.

In Germany, the continent’s locomotive, there is also a divergence, but to the other direction. Manufacturing is picking up steam with an advance from 53.6 to 54.3 points. On the other hand, services are turning south with a slide to 50.6, below August’s 51.7 and under expectations for a rise to 52.2 points.

The all-European figures are trending with the German ones: a bump up in manufacturing to 52.6 points, well above expectations, but a drop in services to 52.1 points.

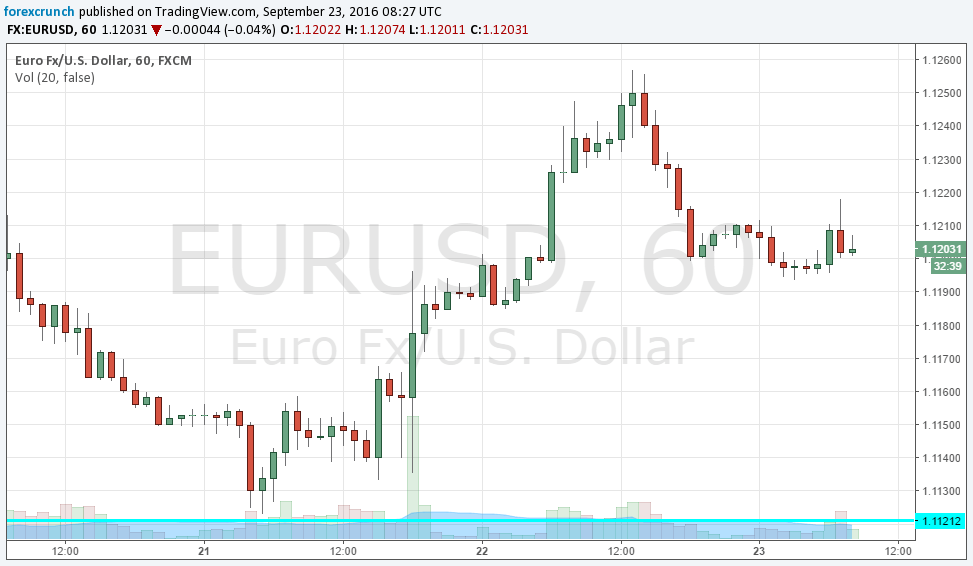

EUR/USD

Euro/dollar is sticking to its range. After a move up to 1.1250, we are back to hugging the 1.12 level. Support awaits at 1.1120. Further support is at 1.1050 and resistance awaits at 1.1370. However, after a bout of slightly stronger movements, the pair is entrenched in a much narrower range.

Will it explode? Here is a video showing hope: