- Markit’s preliminary November PMIs are set to show declines on all parameters.

- Previous beats, vaccine prospects, and light lockdowns make room for an upside surprise.

- EUR/USD has room to rise in response to the data.

Winter has arrived and with it, a surge in virus cases and an economic downturn – that is the main reason to expect a drop in business sentiment. However, the downbeat mood may have gone too far.

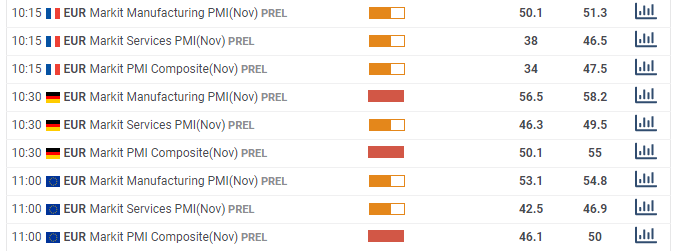

The economic calendar is pointing to significant declines in all of Markit’s preliminary Purchasing Managers’ Indexes in November, based on lockdowns in Germany, France, and most of the currency bloc’s countries.

Source: FXStreet

The all-encompassing eurozone composite PMI is set to fall from 50 – the level separating expansion and contraction – to 46.1 points. Is this indeed the case?

Three reasons to expect upside surprises

1) The cavalry is coming

Pfizer and BioNTech announced their COVID-19 candidate is 90% efficient on November 9, on time to be factored in by Markit’s surveyors. The initial success had the most significant impact on financial markets and also opened the door to others using the mRNA technology. Moderna came a week later with its encouraging results.

While any immunization scheme has production, storage, and distribution hurdles, having this “light at the end of the tunnel” is a considerable boost to morale that could lead to a better PMI.

2) Lockdowns are somewhat lighter

Contrary to the panic shuttering of the economies in the spring, the public, medical staff, and governments are far more prepared for the winter wave. Schools remain open almost everywhere and office workers carry their duties from home.

Moreover, Germany’s lockdown was described by officials as “light.” France has been under stricter measures, yet these have been bearing fruit, potentially also feeding into business confidence.

3) Economists were too pessimistic

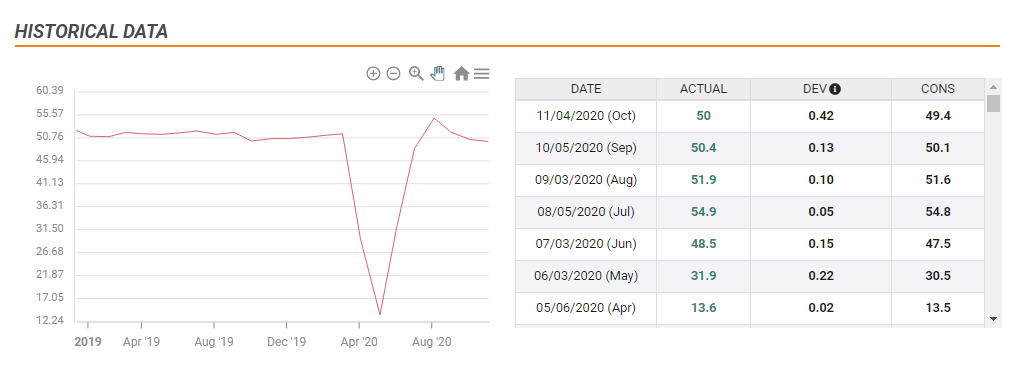

Examining the eurozone composite PMI, the consensus of economists’ estimates was too pessimistic in the past seven releases. While they forecast the general direction of travel in the past three months – to the downside – the outcome beat estimates.

Source: FXStreet

Will recent history repeat itself for the eighth time in a row? A sharp plunge of nearly four points seems inconsistent with recent declines, leaving room for an upside surprise.

EUR/USD reaction

The tug of war between vaccines and the development of the virus remains left, right, and center for markets. Nevertheless, as the dust settles from the vaccine news and previously from the US elections, economic data may come to the fore. EUR/USD has been hesitating after an upside swing in response to immunization news.

Upbeat PMIs, especially the one from Germany’s manufacturing sector and the composite read, could lift the common currency.

Conclusion

Markit’s preliminary eurozone PMIs provide a snapshot of how the old continent is coping with the second wave of lockdowns. Expectations may be too high.

More EUR/USD Weekly Forecast: Bulls remain in control after virus-vaccine struggle