Over the past year Polish voters have twice rejected centralist Civic Party incumbents in favor of populist Law and Justice Candidates. The change in government isn’t because of the economy. Poland’s 3.4% 2014 GDP growth was well ahead of 1.3% GDP growth of its fellow EU members. In spite of the economic problems of the EU, the Greek financial crises and a war in neighboring Ukraine, expectations for 2015 remain surprisingly high at 4%. Moody’s rates Polish sovereigns ‘A2’; Fitch AAA; S&P A-. It should be noted that government debt is restricted by constitutional law at 60% of GDP. Poland seems to have a ‘golden economy’.

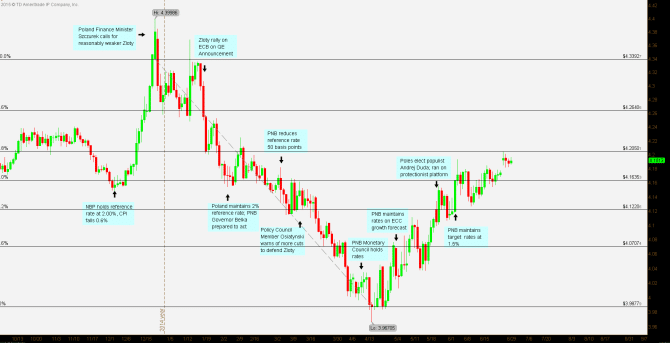

The Zloty has strengthened versus the Euro over the past six months. On 21 April, EUR/PLN found support at 3.96705 per Euro, the strongest since 3.82855 per Euro in January of 2011. In the same period, resistance was tested at 4.3392 per Euro, the weakest point for the Zloty since 4.5988 per Euro in December of 2010. What makes the Zloty a recent consistent performer versus the Euro?

Guest post by Mike Scrive of Accendo Markets

The ‘A’ rated Polish 10 year sovereigns yield 2.82% compared to the 1.26% average of the 28 EU members. By the EU’s Purchasing Power Standard, Poland ranks in the top 19th out of all 28 members. General government debt, at 50.1% of GDP, runs well below the constitutionally enforced limit and well below the EU average of 86.8% of GDP. Taxes are 7% of GDP compared with the average EU 12.9% of GDP. Inflation is almost nil at 0.1% vs EU average of 0.6%.

The country is productive: unemployment is around 9%, below the EU average of 10.2%; only 7.8% are employed part time vs EU part timers at 20.4%; long term unemployment is 4.4% vs. EU 5.1%; the average workweek is 42.3 hours vs the EU 41.5 hours and real unit labor costs declining at -0.9% rate vs. EU -0.4% rate.

Income distribution and those ‘at risk’ of falling below the poverty line is below the EU’s Gini average of 35.0. The country has a high educational standard with 90.4% of the population having completed upper secondary education. In comparison, EU members average of 82.3%. On the other hand, Poland does fall short on social services and GDP purchasing power standard (PPS) ‘per capita’ ranks 23rd of 28.

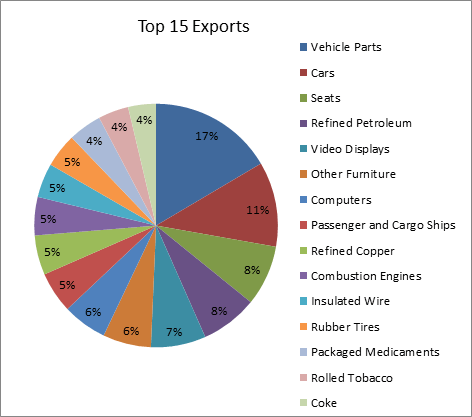

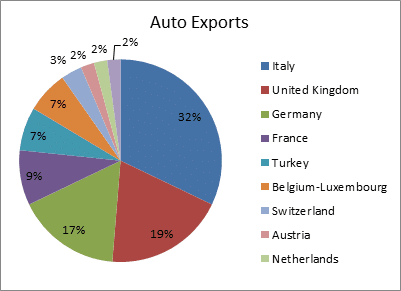

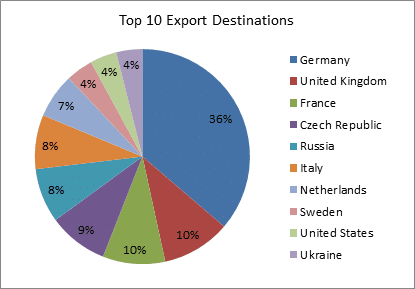

Poland has a well-diversified export economy with a trade surplus for the first 4 months of 2015; no single export accounts for more than 5% of total exports. Over 70% of all trade is with the EU. Exports included finished and intermediate goods, particularly automobiles . Export trade is mainly with the EU, and Germany accounting for over 23% of those exported goods. Poland exports mostly Vehicle Parts, 4.87%; Cars, 3.33%, Seats 2.37% and refined petroleum, 2.33%. Poland’s largest import partner is Germany at 22%. By far, Poland’s largest import is crude oil at 9.42%; 93% of that originating from Russia. Otherwise, Vehicle Parts amount to 2.89% and Autos, about 2.62% of all imports.

At its weakest point in the past year, it was the war in Ukraine weighing on the economy. Customs data indicated a 48% drop in heavy goods vehicles at the Polish Ukraine border. The concerns about the EU economy and the Ukraine war motivated the Narodowy Bank Polski to reduce the benchmark reference rate to 1.5% from 2%. The reverse from the high was also partly in response to a negative EU CPI measure, the first such decline since 2009.

The reversal began in earnest when NBP board member Andrzej Rzonca suggested the bank would not reduce further. NBP Governor Marek Belka followed up by saying that ECB QE liquidity would be enough to boost the Zloty. Indeed, good economic news continued for Poland’s economy while the news for the EU only seemed to worsen. Poland’s Labor Minister Jacek Mecina voiced optimism, expecting unemployment to drop below 10% in 2015. Further, auto manufacturing, a major export, rebounded. The Zloty rallied first off the Swiss action and then a late January rally on the ECB QE announcement. At one point, the Zloty was the best performing of all 24 emerging market economies. The monetary council voted down rate cuts in January and February while other central banks cut, trying to stem the tide of cash flowing out of the Eurozone into higher yielding non-Eurozone member bonds.

The NBP eventually cut rates 50 basis point on 4 March, amazingly, with little market reaction. Sovereign bonds across the Eurozone continued to climb, driving yields ever more negative. Highly rated positive yielding Polish sovereigns became ever more attractive. Polish Monetary Councilman Jerzey Osiatynski alluded to ‘currency wars’, then warned that the council would cut further if need be. However, at the 15 April policy meeting, the Council voted to maintain the 1.5% reference rate. Resistance was finally found at the 52 week low 3.96705 21 April, about the start of the global bond unwind; the PNB held the reference rate at 1.5% at the May meeting.

In retrospect, over the past year Poland’s central bank was a disciplined step ahead of the EU as a whole. With generally higher sovereign rates, good credit ratings, a resilient economy and demand for its main export, manufactured automobiles, all bode well for increased capital inflows while the Eurozone remained in ‘secular stagnation’. With the expanded ECB QE still providing liquidity to the tune of €60 billion per month, the major concern for Poland remains the Ukraine standoff. It should be noted that in response NATO has built up forces in Poland. Most likely it’s a ‘demonstration of resolve’, but more realistically, it may contribute to Polish GDP.

As long as demand for autos remain strong, the Ukraine crisis not worsen and the Eurozone economy remains weak, it’s not unreasonable to consider the Zloty as the potentially stronger currency versus the Euro.

Mike Scrive

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.“