EUR/USD stabilized and even broke to the upside from the low wedge. Nevertheless, many still cast doubts about this euro recovery.

The team at Barclays explains why EUR/USD is still on the cards by year end, and also set intermediate targets:

Here is their view, courtesy of eFXnews:

Until positive growth surprises begin to materialize and the disinflation concerns fade, the market will likely lessen its conviction on a stronger USD and stay cautious on risk, says Barclays Capital.

“The Fed may need to provide reassurance to market participants that it will remain patient until inflation expectations re-establish more comfortable grounds and will not normalize rates under the current lingering concerns,” Barclays adds.

“In other words, we would expect the Fed to maintain the monetary policy put until growth numbers become stronger, while making the point that as soon as that becomes evident, the market should see policy normalization as the natural next step. This logic suggests that upcoming growth data releases will be key for US rates and the USD. We would expect the EUR to become particularly sensitive to US growth data in Q1 and beyond,” Barclays projects.

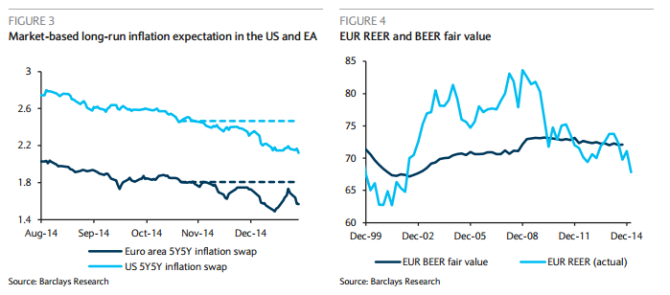

Against the backdrop of a constructive US outlook and a more proactive ECB, Barclays continues to see significant downside to EUR/USD.

“We expect the EUR to reach a level of valuation equivalent to a 2 standard deviation misalignment when the Fed is fully embarked on normalization while the ECB keeps buying bonds. This would express our expectations that the business cycles in the US and Europe will see an unprecedented gap,” Barclays argues.

Given this, Barclays now sees a gradual EUR/USD decline of 15 big figures from current levels towards 1.08 in Q2, 1.05 in Q3 and 1.00 in Q4.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.