EUR/USD dipped in the new week as USD/JPY was seeking a fresh direction. What’s next?

The team at Goldman Sachs examines the technicals:

Here is their view, courtesy of eFXnews:

EUR/USD keeps hovering around the 55-dma and the July ’14 downtrend around 1.1095, notes Goldman Sachs Techs.

“Both of these levels have been very relevant to recent price action. The 55-dma in particular held the entire decline from the May ’13 high to early-April,” GS adds.

If the pair manages to break back above these levels, then GS sees the next big pivot to focus on is 1.1168; an ABC from the Jul. 20th low.

“A close above will open potential for a 1.618 extension target to 1.1366. This also happens to be close to the previous two highs from May/June (1.1438-68) and a 0.618 extension from March (1.1432). Overall, seems the next two big levels are 1.1168 and then 1.1366-1.1468,” GS projects.

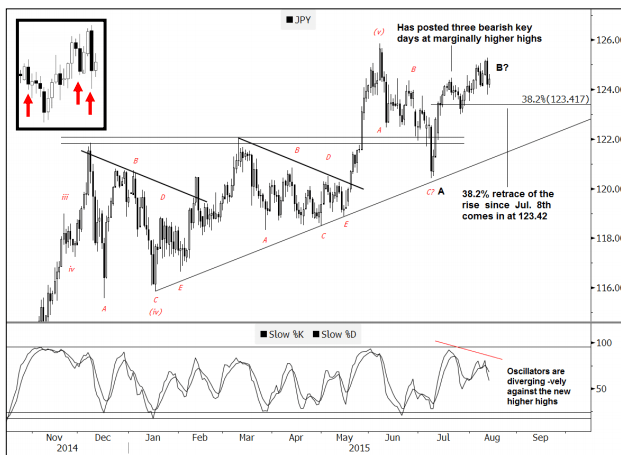

Turning to USD/JPY, GS notes that its rally since July 21st looks like an upwards sloping (bearish) wedge.

“The market has posted a series of three separate bearish key day reversals since Jul. 21st . Each one was posted from a new local high. Each one was slightly larger than the previous one. Moreover daily oscillators are diverging negatively against the recent trend of higher highs,” GS adds.

“Bottom line, although there’s still no material downtrend to chase, USDJPY is clearly edging higher on poor momentum,” GS concludes.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.