Euro dollar is steady on low ground, under support it lost yesterday. Concerns about Spain’s “extremely difficult” situation, and echoes from the relatively bullish FOMC minutes continue to push weigh on the pair.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

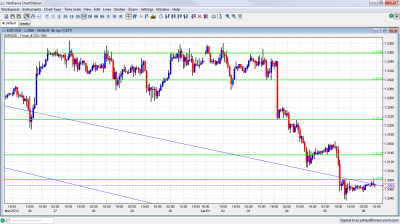

EUR/USD Technicals

- Asian session: The pair consolidated under 1.3080, after the downfall seen yesterday.

- Current range: 1.30 to 1.3080.

- Further levels in both directions: Below: 1.3080, 1.30, 1.2945, 1.2873 and 1.2760.

- Above: 1.3212, 1.33, 1.3437, 1.3486, 1.3550 and 1.3615.

- 1.3080 proved to be a distinctive line separating ranges – once broken to the downside, it immediately switched to resistance.

- 1.30 used to be a round number without technical strength, but the recent challenge showed it is a serious barrier. So, the pair is in a tight, strong range.

Euro/Dollar is on low ground before the NFP – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:45 French Trade Balance. Exp. -5.1 billion. Actual -6.4 billion.

- 12:30 US Non-Farm Payrolls. Exp. 207K. See how to trade this event with EUR/USD.

- 12:30 US Unemployment Rate. Exp. 8.3%. Could be a disappointing surprise here as formerly discouraged workers try their luck once again.

- 12:30 US Average Hourly Earnings. Exp. +0.2%.

- 19:00 US Consumer Credit. Exp. 12.5 billion.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- All Eyes on Non-Farm Payrolls: The signs leading to the release of the “king of forex” were positive: ADP showed yet another healthy gain of 209K jobs (with an upwards revision of last month), the employment components of both services and manufacturing sectors were on the rise and jobless claims remained stable on low ground. The only fear is a rise in the unemployment rate, given a return of formerly discouraged people to try their luck in the workforce. Not all of them will be lucky. Expectations are for no change, so any tick up will be disappointing.

- Spanish worries: Spain had a very disappointing bond auction, reversing the success it had earlier in the year, when the LTRO was in play. This joined an minus comment by Citigroup chief economist said that the chance of a Spanish default is now higher.. Europe remains very fragile.

- Greek foreign law bond deadline extended: Thought that the Greece will be out of the limelight for long? Think again. The holders of foreign law (mostly English-law) bonds refuse to accept the bond swap, and there’s no way Greece can force them to. The Hellenic Republic extended the deadline to April 20th, but the actual deadline is May 15th, when it needs to pay out. Any additional payment will stress the Greek government during an election period, and will complicate the tight calculations for its recovery. Greece didn’t declare bankruptcy on March 23rd, but this danger looms during the long Easter holiday, as well as every weekend until May 15th.

- European Recession Concerns: The euro strengthened after euro zone finance ministers agreed to strengthen the region’s debt firewall on Friday, but concerns remained over whether the measures would be enough to prevent contagion to other Euro-zone economies, notably Spain. As expected, the ECB left interest rates unchanged at 1%.

- China slowdown easing?: The markets cheered the Chinese Manufacturing PMI figures, which climbed to an 11-month high of 53.1, above market forecasts. Further strong data out if China would raise hopes about renewed activity in the Asian giant’s economy.

- The continuing retreat in European manufacturing. All of the major European economies recorded a PMI reading of below 50 last month. In France, for example, the final reading for March was revised down very sharply from an already very weak preliminary figure. In contrast, in the US, PMI figures have been comfortably above 50, including the Non-Manufacturing PMI released earlier this week.

- FOMC Dampens Likelihood of Interest Rate Hike: The FOMC March meeting minutes indicated that the Fed will not launch a third round of quantitative easing unless the rate of growth falters or inflation drops below the central bank’s 2% targeted rate. The news had a strong effect on the currency markets, as the Euro has fallen over 1% against the dollar since the FOMC release.