EUR/USD started the new week with limited gains within the well known range, but is unable to break higher. A report that the ECB will set a cap on bond yields is making the rounds and supporting Spanish bonds and the common currency. On the other hand, worries about a “manageable” exit of Greece weigh on the pair as the Greek PM sets sails to European capitals.

Here’s an update about technical lines, fundamental indicators and sentiment regarding EUR/USD.

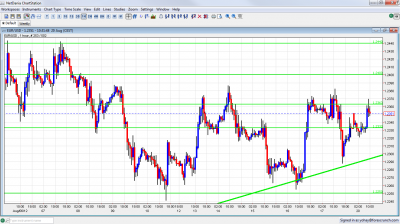

EUR/USD Technical

- Asian session: Euro/dollar began with a small gap higher, then retreated and rose again in the wake of the European session.

- Current range: 1.2330 to 1.2360.

Further levels in both directions:

- Below: 1.2330, 1.2250, 1.22, 1.2144, 1.2043, 1.20, 1.1876 and 1.17.

- Above: 1.2330, 1.24, 1.2440, 1.2520, 1.2623, 1.2670, 1.2743 and 1.2814.

- Note that the pair enjoys uptrend support – it started in mid-July and the pair bounced off this line.

- 1.24 is looming above. Currently the pair is stuck under 1.2360.

- 1.2250 is strong support.

Euro/Dollar enjoys yield cap talk – click on the graph to enlarge.

EUR/USD Fundamentals

- No events today

EUR/USD Sentiment

- ECB Discusses Cap on Yields: A report in Der Spiegel sheds light on a proposal to set clear caps on bond yields. After Spain finally submits its request (still awaited for more than two weeks), the ECB will buy bonds en masse, and will defend a preset yield like the SNB defends the EUR/CHF floor. Such a strong commitment will likely calm investors, as long as the ECB doesn’t have seniority. Spain is still trying to understand the conditions needed from the country in case of massive ECB help. In the meantime, the yields are falling on Spanish bonds.

- Greek PM Begins Critical Tour: Greece raised money last week and avoided a default on the August 20th deadline. However, Greece is still in deep trouble. Greek PM Antonis Samaras wants more time (until 2016) to meet targets, and the creditors aren’t so keen on giving Greece more time and more money. Samaras will meet Juncker, Hollande and Merkel in important week for Greece. In the meantime, talks about a manageable Grexit are heard again: this time from the ECB’s Jörg Assmussen, that echoed Eurogroup chief Juncker. Talks with the troika will continue in September. See how to trade the Grexit with EUR/USD.

- Merkel pledges support: The leader of Germany returned from her vacation and reiterated the call to do “everything” to save the euro. She also provided her support for the ECB’s moves, after some German politicians wanted to intervene in the central bank’s actions and / or change the voting rules there, in objection to the planned QE blitz. In the meantime, Germany still enjoyed nice growth in Q2, but business sentiment is falling there.

- Mixed signals in the US: There is a distinct difference between the struggling manufacturing sector (as seen in the NY and Philly indices) and the housing sector, which continues to surprise. Retail sales came out better than expected and jobless claims remain at relatively low levels. Speculation about QE by the Fed refuses to go away. Boston Federal Reserve President Eric Rosengren recently declared that the Fed should implement QE3 in order to help the troubled US economy. The fear of deflation triggered QE2. Deflation isn’t here yet, but the recent slide in inflation gives fuel to the QE3 camp. Fed Chairman Bernanke poured more cold water on QE intervention by the Fed, calling it a program of “diminshing returns”.