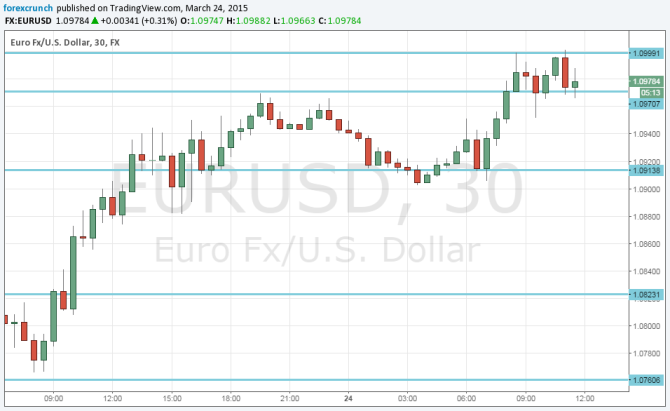

EUR/USD is trading at a narrow high range between the previous high of 1.0980 and 1.10. It did flirt with this level following the better than expected German PMIs but could not make the real break.

The attention of markets has shifted to the tragic crash of flight 4U9525 from Barcelona to Dusseldorf. 154 people have reportedly been on board the German Wings flight that crashed in the French Alps. Details are still emerging and there is fear not only for the passengers but also for people on the ground.

The tragedy has no forex implications, but the lack of attention means perhaps somewhat lower liquidity.

Since Draghi and the Non-Farm Payrolls sent the pair below 1.10 early in the month, we had one “flash” move above this level, following the Fed decision. However, in the bigger scheme of things, this can be brushed off as a false break. The move was very short-lived.

We will later get important data from the US: inflation data. Oil prices are predicted to keep pushing the headline numbers lower.

More: 3 Reasons Why Selling EUR/USD Still Attractive – RBS

Here is how this looks on the chart:

In our latest podcast we discuss The Fed and the road ahead – all you need to know

Subscribe to Market Movers on iTunes