EUR/USD was partially drawn down by the pound flash crash but it managed to recover. The range frustrates many and the team at SocGen sees a potential for a breakout.

Here is their view, courtesy of eFXnews:

EUR/USD remains locked into a narrow and somewhat unstable range, anchored by the net accumulation of EUR 600bn per annum of long-term foreign assets that comfortably exceeds the current account surplus. The rapidly shrinking scope for further ECB easing, an economic backdrop that is stable rather than deteriorating any more, and the funereal pace of fed tightening meanwhile, all stand in the way of further Euro weakness.

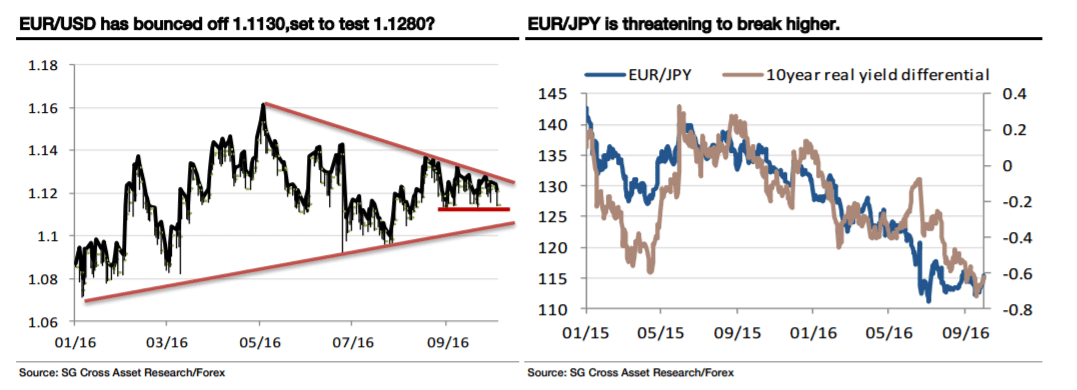

As long as the ECB does keep policy easy enough and as long as the Fed does tighten in December, the default guess is that we will eventually break through the bottom of the current mini-range at EUR/USD 1.1130 (horizontal line below) and test for the 2016 uptrend around 1.1045. But anything which slows the pace of those capital outflows significantly can cause a bigger spike higher in EUR/USD, at least temporarily. 1.1280 is the near-term point to watch.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

The suggestion that the ECB will start o taper its bond purchases triggered the bounce to current levels and if we were to see a shift in policy to less bond-buying and to more TLTROs, that could be good for peripheral growth and by dragging domestic investors who have been crowded out of the European bond market back in, would be positive for the Euro. If!!

I still view a sharp Euro bounce as a ‘tail risk’ rather than a central scenario, but we have argued that this is a good reason to be long EUR/GBP* and that trade still appeals. And as we test the 2016 EUR/JPY downtrend, just above 116, a break of that level potentially opens the door to a move to 122.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.