EUR/USD just keeps marching on, taking advantage of the weak US dollar, that just keeps on suffering Yellen’s extreme dovishness. By repeating and even taking a further step in seeing the glass as half empty, the Fed Chair sends the US dollar to new lows.

For EUR/USD, this means the highest level since October, nearly 6 months, and just before expectations towards the ECB’s meeting in December became huge.

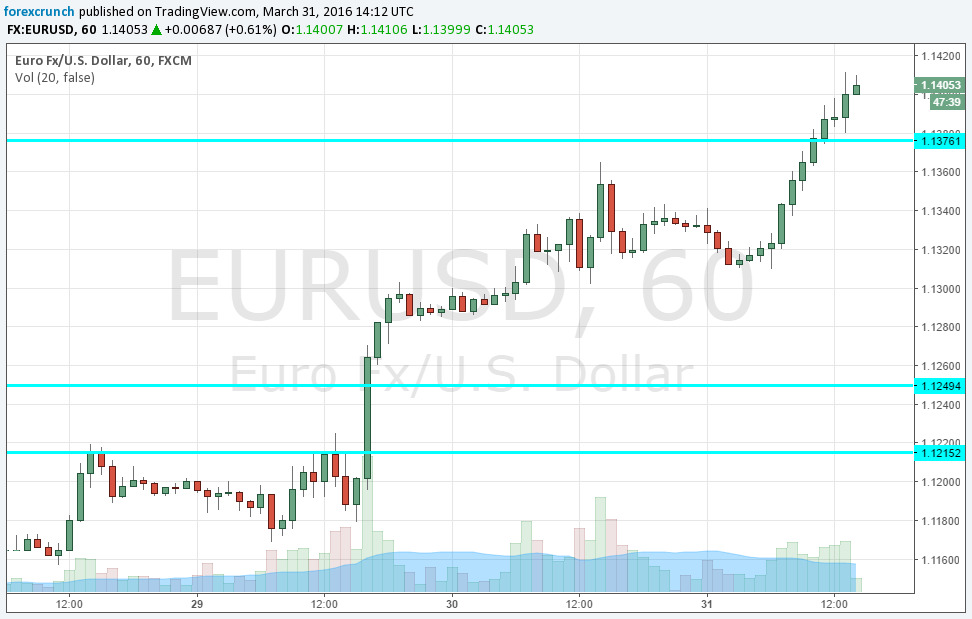

Here is how the recent move looks on the chart. The pair made a move above 1.1375, which was the high in mid February. The euro then enjoyed safe haven flows amid the peak of the doom and gloom.

Since then, the ECB introduced some stimulus (that backfired), the Fed went dovish, the Fed hawks awakened and now Yellen seems to have the last word, well, at least until tomorrow’s Non-Farm Payrolls.

See how to trade the Non-Farm Payrolls with EUR/USD.

Why is EUR/USD rising

- Yellen’s dovishness is the main driver: She said that caution is especially warranted.

- Weak US jobless claims: The rise from 265K to 276K is not a disaster, but it serves as an excuse to sell the dollar further

- End of quarter flows: The last minute adjustments seem to be unfavorable for the US dollar

- Unwillingness to act from the ECB: We heard several comments that the ECB has reached its limits, more or less echoing Draghi.

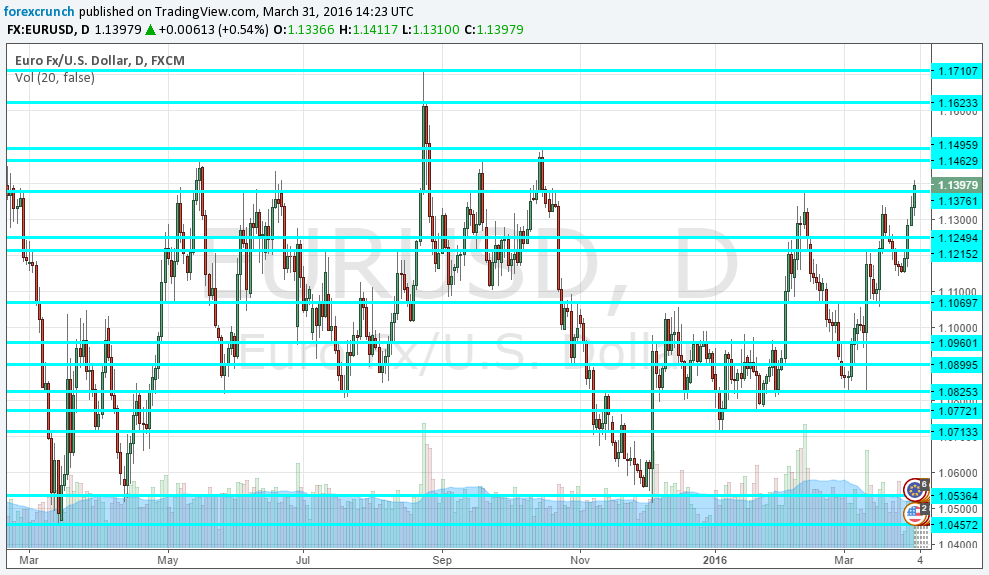

EUR/USD levels

EUR/USD is now at the 1.14 handle and the next level is 1.1460. This figure is of importance as it was the peak of the bit euro recovery back in 2015. It is also exactly 1000 pips off the 12 year lows of 1.0460 and later worked as resistance.

Further resistance awaits at close by, at the round figure of 1.15. On the way up, 1.1650 served as some support in the past and is the last barrier before 1.1712, the level where the pair stalled in August 2015, when the Chinese stock market crashed.