Does the dollar have more room to run? Against the euro and the Australian dollar, the team at Credit Suisse certainly thinks so.

Here is the technical analysis, explanation and targets for both these interesting pairs:

Here is their view, courtesy of eFXnews:

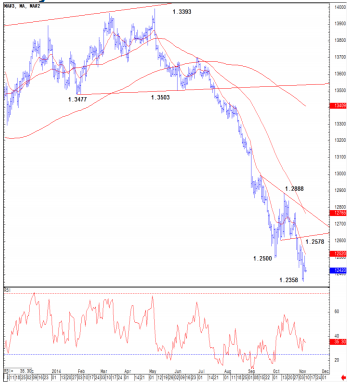

EUR/USD’s post payroll bounce has been capped below price resistance at 1.2534/41, notes Credit Suisse.

“The reversal ahead of here keeps the immediate risks lower, with a move below 1.2411 seen as the trigger to retest the 1.2358 recent low,” CS argues.

Below here, according to CS, should see 1.2256/42 initially, ahead of potential medium-term trend support at 1.2229/21 where CS would look for better buying to ideally start to show here.

“Near-term resistance is placed at 1.2510, but above 1.2541 is needed to see further gains to 1.2560/78 – the 38.2% retracement of the decline from the 1.2888 high, which we look to cap,” CS adds.

In line with this view, CS maintains a short EUR/USD position with a stop at 1.2645, and a target at 1.2230.

In AUD/USD, CS notes that its corrective bounce has also been capped at the 38.2% retracement of the recent decline around .8684.

“We look for this to try and cap for a break below .8608 and a move back to .8568, then a retest of .8546/41 – the 50% retracement of the 2008/2011 uptrend and recent low. Whilst a fresh hold here should be allowed for, a break in due course should target medium-term channel support, currently seen at .8480,” CS adds.

“Above .8684 can see a deeper corrective recovery to the 21- day average at .8727, potentially price and gap resistance at .8763/64, where we expect better selling to show,” CS projects.

In line with this view, CS runs a limit order to sell EUR/USD at .8725 targeting .8550.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.