EUR/USD was struggling at the bottom of the range as volume returned to normal. Traders in the UK and in the US are back to business. Yet after the initial sell-off, the pair is recovering.

The good news comes from France’s GDP report. The updated estimate show a growth rate of 0.4% q/q in Q1, better than 0.3% originally reported. This may result in an upgrade to the euro-zone GDP.

However, inflation figures missed expectations. Spain saw a significant slowdown, with fuel prices dragging down the year over year GDP number from 2.6% to 1.9%, below 2.1% expected.

Inflation figures are dripping from the various states of Germany and they also point to a moderation. The drop in year over year figures are also around 0.5% in comparison to the previous month. We will get the all-European figure at 12:00 GMT.

Inflation is expected to drop in May after a bump-up in April. Yet while headline inflation can be transitory, the ECB has recently put more emphasis on core inflation. These have reached 1.2% in April, the highest since 2013. A drop to 1% is on the cards now.

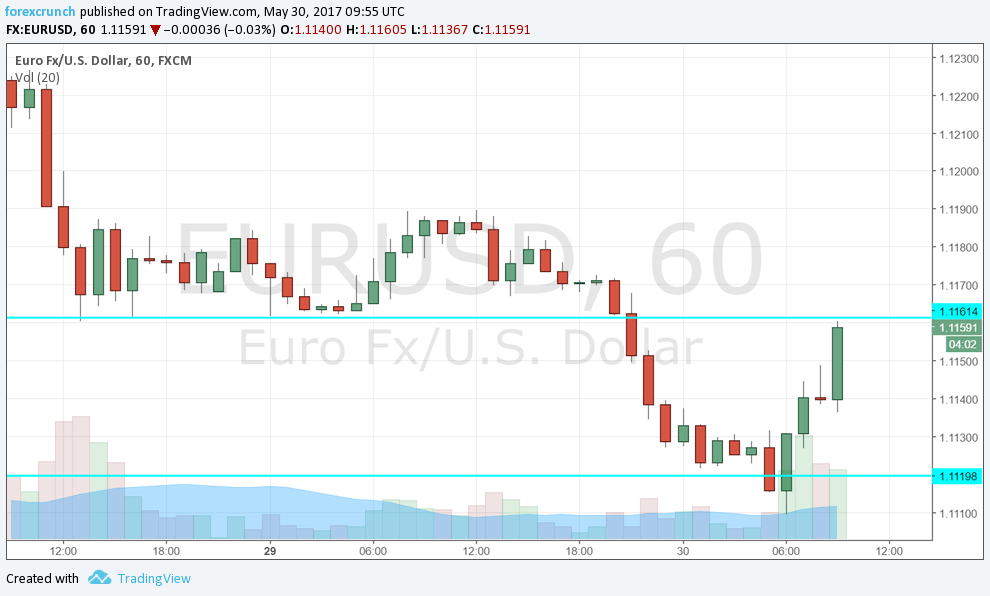

EUR/USD levels

All in all, this rise in EUR/USD is not really justified: the upgrade in French GDP does not compensate for the drop in CPI that the ECB cares about. And, we can see some dollar weakness across the board, so the slide is not unique to the common currency.

Support remains at 1.1120. The dip under that level seems like a false break. Further support awaits at 1.1050, followed by 1.0950. Resistance is at 1.1160 which worked previously as support. Further above, 1.1266 is the cycle high.

More: EUR/USD: Tactical Profit-Taking – Barclays