Last Friday’s good Non-Farm Payrolls triggered a greenback come back. The dollar was a winner against the euro, with EUR/USD finally making a significant correction.

And this correction may have run its course. The common currency held on quite well, clinging to support at 1.1710 after the JOLTs report and gradually recovering after the poor PPI numbers from the US.

And now, a full week after that big correction, the pair is on the rise once again. It emerges as the biggest winner from a miss on the US inflation report that fell short of expectations.

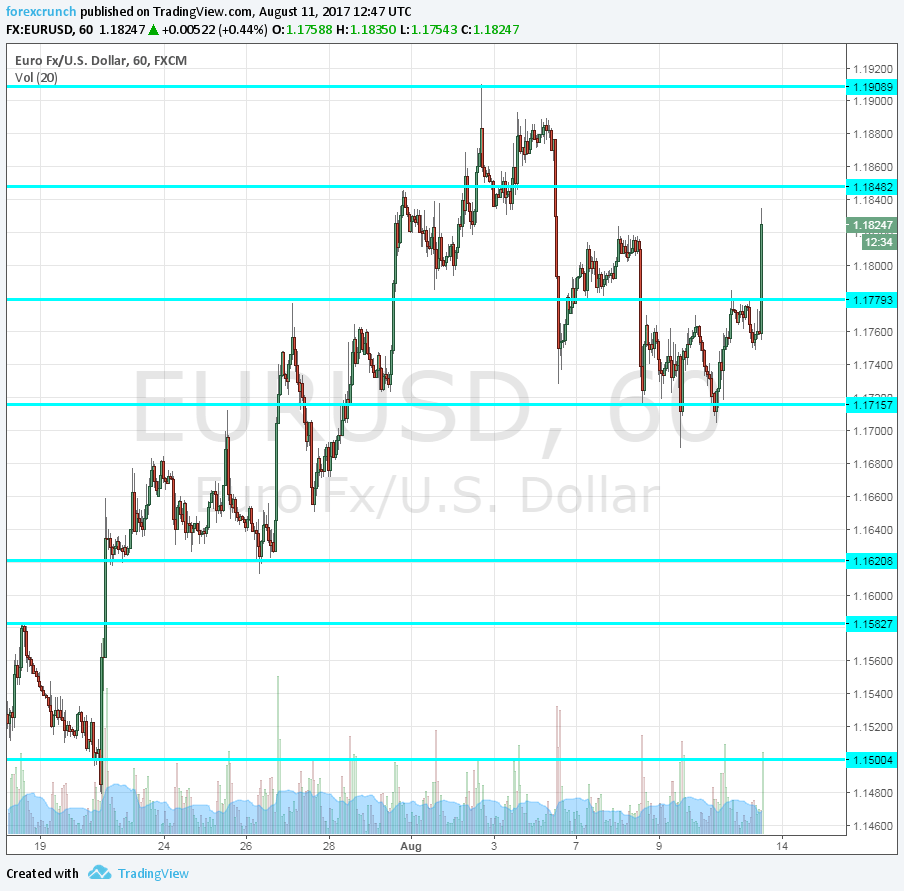

EUR/USD levels to watch

EUR/USD is up to 1.1823, the highest level since that big fall. The next line of resistance is 1.1870, which temporarily capped the pair on its way up and served as support in 2010. Further above, the cycle high of 1.1910 is closeby.

And the next big target is not that far either: 1.20. The round number is eyed by many and could trigger some unhappy reactions from the European Central Bank. On the other hand, Draghi’s “everything it takes” speech came when the pair bottomed out at 1.2040 back in 2012. Support awaits at 1.1710 and 1.1620.

The euro has gone a long way down and may have a long way to run to the upside. Here are 5 reasons for the rise of the euro.