After the FED raised rates and went hawkish, EUR/USD broke down below the 2015 low, and trades at levels last seen around 14 years ago. Many see EUR/USD parity as the next logical step. But there is one factor that could ruin the party:

Here is their view, courtesy of eFXnews:

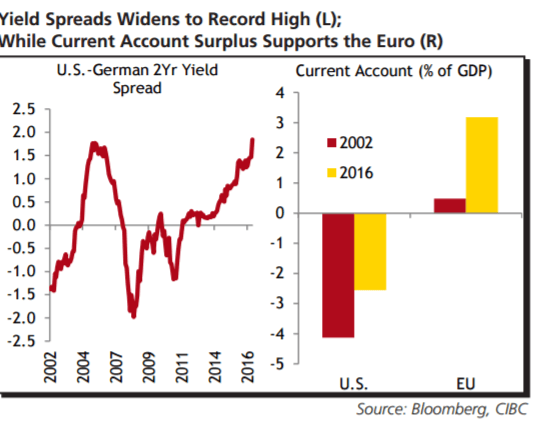

After trading above US$1 for more than a decade, the EUR appears to be slipping towards parity against the greenback. The depreciation toward that mark is due to the recent pick up in the US dollar caused by increasing yields, with the 2-year yield spread between US-German bonds reaching a decade high.

However, there is a countervailing force which could spoil a New Year’s parity for EURUSD. The current account surplus in the Eurozone is not only large, it is much higher as a share of GDP than when the euro traded below parity back in 2002. With a lot already priced in in terms of US fiscal and monetary policy, the current account surplus in Europe should see the euro gradually regain some recent lost ground in 2017.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.