Draghi offered dovish words but never went too far regarding details. Euro/dollar maintained its strength. As the focus shifts to the Fed, the team at BNP Paribas sees weakness.

Here is their view, courtesy of eFXnews:

The ECB refrained from announcing new easing measures at today’s monetary policy meeting. President Mario Draghi stated in the press conference that the central bank did not discuss an extension of the current asset purchase programme. He stressed that risks to economic growth lie to the downside but that, for the time being, changes to the ECB’s growth and inflation forecasts are not significant enough to warrant more easing. However, our economists view today’s decision as a postponement rather than a rejection of further easing with new announcements likely soon, most probably at the December ECB meeting after a full evaluation of the options available.

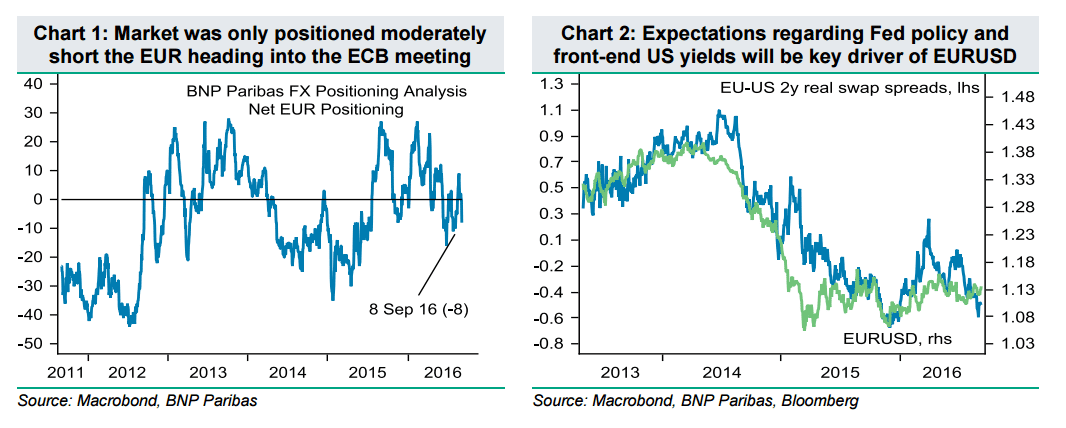

The EUR initially benefitted modestly from the ECB’s decision to leave policy unchanged with EURUSD rising from 1.1290 before the announcement to a high of 1.1328. Given that short EUR positioning is quite light, at -8 in the range of -50 to +50 according to BNP Paribas FX Positioning Analysis, we would not expect the EUR’s squeeze upward to extend on the topside and be sustained.

The ECB has passed the baton to the US Federal Reserve regarding determining EURUSD’s direction. Overall, disappointment at the lack of an ECB policy adjustment has only been worth about 2bp on the EUR 2y swap rate. Hawkish comments from key members of the US Federal Reserve ahead of next Tuesday’s start of the blackout comment period could easily move US front-end yields by several times that amount very quickly.

We continue to forecast a fall in EURUSD to 1.08 by the end of the year, consistent with our economists’ view that the Fed is likely to raise US rates by 25bp at the 21 September meeting (versus market pricing in of only a 20% probability of such a rate hike).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.