Hello traders!

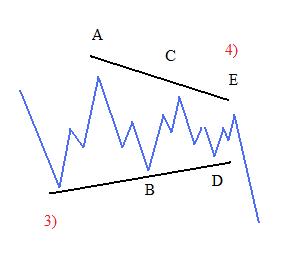

Eur/Usd ride is like a roller coaster for the last few days if not weeks, ups and downs with 200 pips and more. From a technical Elliott Wave perspective that’s all normal if you consider a triangle formation. Triangles are structured by five legs, A-B-C-D and E, and as such, we anticipate even more sideway as we still need to see waves D and E before a triangle can be completely finished. Here is a basic triangle structure which occurs in wave four in an impulse or in wave B position of a zig-zag.

Be patient, we don’t want you to get caught in this range bound market, but we favor a bearish scenario as long as the Eur/Usd trades below important 1.3500 resistance region.

Happy Holidays!

If you need more Elliott Wave forecast, please visit our website and check Video Tour of Our Products here. Special holiday offer: Get 2 months for price of 1″, expires on Jan 3rd 2011!