The US dollar enjoyed Wednesday’s hawkish hike, rising on that day before extending the moves on Thursday. On Friday, the greenback already took a break and the new week opened without any special trading.

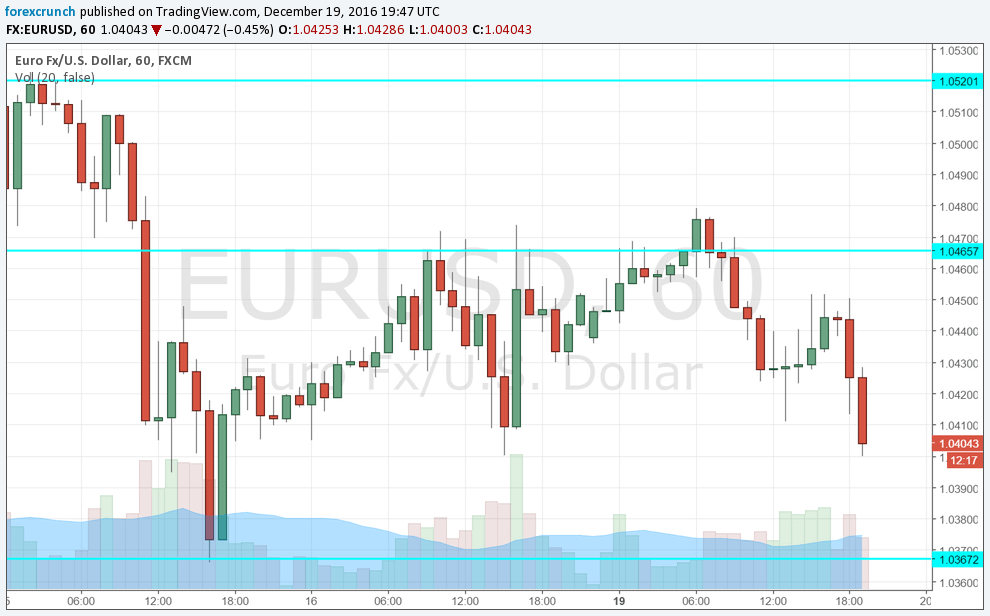

For EUR/USD, the consolidation meant the pair drifted back up to the 1.0460, the low of March 2015 it finally broke on Thursday. But despite some attempts to reconquer this level, the pair never really settled above it.

But now, amid worrying news, the pair falls to 1.04 once again.

The Russian ambassador to Turkey was murdered in an opening of a gallery in Ankara. The killer, a police officer, cited Syria and Aleppo for his action. The war in Syria spills elsewhere.

In Berlin, a truck driver ran into the traditional Christmas Market, killing at least one person. Authorities suspect this is an act of terror.

The dollar also has a role of a safe haven currency, even though the yen is the king of safe havens. Is the move related to the tragic events? Or is it a natural resumption of the dollar rally after a much-needed break?

In any case, the low of 1.0366 seen last week is the first line of support. The next one is 1.0340, which had a role back in 2003. The road to parity is open.